Indian refineries stop buying Russian oil again after US tariffs – Bloomberg

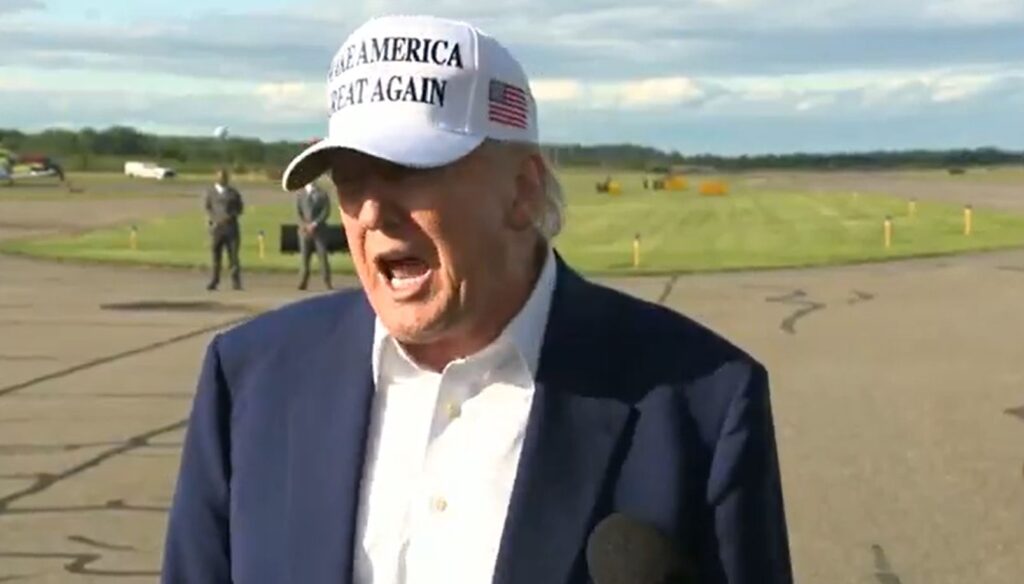

India’s state-owned oil refiners have temporarily halted spot purchases of Russian crude following President Donald Trump’s imposition of additional 25% tariffs on Indian exports to the US, according to Bloomberg sources with direct knowledge of procurement plans.

Companies including Indian Oil Corp., Bharat Petroleum Corp. and Hindustan Petroleum Corp. “plan to skip spot purchases of the crude in the upcoming buying cycle, until there’s clear government guidance,” Bloomberg reported on 7 August. The companies asked not to be identified as they aren’t authorized to speak publicly.

The pause will specifically affect purchases of Russia’s Urals crude cargoes scheduled for October loading.

Indian Oil Corp. demonstrated the shift by purchasing five million barrels of oil from the US, Brazil and Libya – “the latest in a string of purchases for relatively quick delivery,” Bloomberg reported.

Trump’s tariff escalation represents “a direct punishment for the country’s refiners taking Russian crude” and is designed to pressure Moscow to end the war in Ukraine, according to the report. The measure has not yet been matched by similar action against China, another major buyer of Russian oil.

The development has impacted global oil markets, with Brent crude trading near $67 a barrel on Thursday following a five-day decline as traders assess potential supply disruptions.

Despite the corporate response, New Delhi has not officially directed refiners to stop buying Russian crude. Prime Minister Narendra Modi’s government continues to push back against Trump’s tariffs, Bloomberg said.

The temporary halt comes as India has become one of the world’s largest buyers of Russian oil since the Ukraine war began. At its peak, India imported more than 2 million barrels per day of Russian oil, up from nearly zero purchases before the conflict.

The situation reflects the broader geopolitical tensions over energy flows, with Washington intensifying pressure on countries that continue purchasing Russian energy exports. While overall October-loading Urals purchases by Indian refiners are unlikely to drop to zero, traders anticipate the reduction could prompt increased demand for US, Middle Eastern and African crude alternatives.

Oil ministry spokesmen and representatives from Indian Oil Corp., Bharat Petroleum Corp. and Hindustan Petroleum Corp. did not immediately respond to Bloomberg’s requests for comment.