Ukraine’s Long Neptune missile, drones hit Russian oil terminal and air defenses in Novorossiysk

Explosions were recorded in Novorossiysk overnight on 14 November as Ukrainian forces conducted a combined missile and drone strike on the Russian Black Sea port city, 300-400 km from the southern sections of the frontline in Ukraine. Fires were observed at an oil terminal and military installations, with video footage, satellite imagery, and local reports confirming multiple impact sites across the area.

Ukrainian drones and missiles hit multiple targets in Novorossiysk

The attack began around midnight, with explosions reported in various districts of Novorossiysk in southern Russia's Krasnodar Krai.

Ukrainian Telegram channel Exilenova+ published multiple videos and images from the scene. In one of the videos, a woman is heard descibing an explosion she saw before starting to film the video and then reacting to a new sudden blast: “It lit up just like this.”

Eyewitness footage showed significant fires and rising smoke in multiple locations.

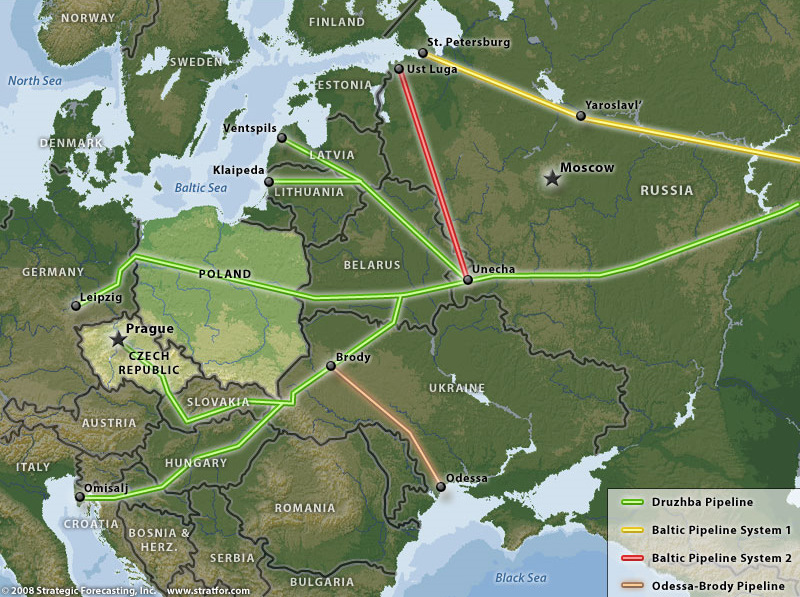

The site, a strategic end-point for Transneft’s pipeline network, lies 300–400 km from the frontline and plays a key role in Russia’s Black Sea oil exports.

— Euromaidan Press (@EuromaidanPress) November 13, 2025Exilenova+ pic.twitter.com/XFq2OmwYOH

Several videos captured Russian air defense launches, including one missile falling into the sea and another—or the same recorded from the opposite angle—illuminating the horizon.

Posting two clips of a particularly large explosion, Exilenova+ first stated that the strike hit military unit 52522, likely at an ammunition depot, and identified the point of view's coordinates as 44.6714567471, 37.7787317922. An updated post said a suspected S-400 air defense system position was located behind a “Lenta” mall, seen in the clips. Open-source researchers from the Cyberboroshno community stated that S-300 or S-400 positions belonging to military unit 1537 of the Kuban anti-aircraft missile regiment were hit.

Not just the oil terminal: Another strike on Novorossiysk captured from two angles

— Euromaidan Press (@EuromaidanPress) November 13, 2025

Exilenova+ believes it hit the military unit 52522, possibly an ammunition depot.Exilenova+ https://t.co/48xX2tePCz pic.twitter.com/7AW9xD6U5t

Chernomortransneft terminal ablaze, oil exports halted

Videos showed that during the air assault, fires broke out at Transneft's Chernomortransneft oil terminal in the Sheskharis area of Novorossiysk following the aerial attack. The site is a key point in the Transneft pipeline network. NASA’s FIRMS satellite system also recorded numerous fire outbreaks in the Novorossiysk area.

Reuters cited two unnamed industry sources who said that Transneft's oil exports from Novorossiysk were suspended after the attack.

Due to the overnight attack, the airports in Krasnodar and Gelendzhik temporarily suspended operations.

Ukraine reveals new Neptune launcher platform

On 14 November, President Volodymyr Zelenskyy published a video showing a modified launcher for the “Long Neptune” cruise missile.

Ukraine launched its Long Neptune missiles at targets in Russia, Zelenskyy said

— Euromaidan Press (@EuromaidanPress) November 14, 2025

He didn't specify the exact targets, but last night's footage of a powerful explosion suggests that at least one Neptune has struck Russia's Novorosiysk.TG/Zelenskyy https://t.co/j6P01SKzNM pic.twitter.com/d3K4KZPJA6

Militarnyi notes that the system is mounted on a Tatra chassis and fitted with square transport-launch containers designed for two longer missiles. Zelenskyy said that Ukrainian forces used the Long Neptunes successfully overnight against designated targets in Russian territory.

The Ukrainian strikes came amid Russia's massive air and drone attack on Kyiv. Zelenskyy called the Ukrainian strike a “just response to continued Russian terror” and stated that Ukrainian missiles demonstrate growing accuracy and effectiveness each month.

Russia issues official statements

Russia’s Ministry of Defense claimed that its air defense forces shot down 66 Ukrainian drones over Krasnodar Krai during the night.

The emergency task force of Krasnodar Krai acknowledged damage to the oil depot at the Sheskharis transshipment complex and a "civilian" ship in the port — possibly an oil tanker of Russia's "shadow fleet," used to circumvent G7's oil sanctions.

It also claimed that drone debris have fallen in several areas of the city.

Read also

-

Russia launches massive air attack on Kyiv, killing 6 and wounding 36 civilians across the capital—children and pregnant woman among the injured (UPDATED)

-

Oil terminal, radar site, and command posts hit in Ukrainian strikes across occupied and Russian territory, GenStaff says (VIDEO, MAP)

-

Russia’s Tuapse port hit again — ship burns, pier damaged, Russian officials scramble to rewrite reports (VIDEO)