War in Ukraine could end within months if Europe targets Russian oil buyers, US treasury chief says

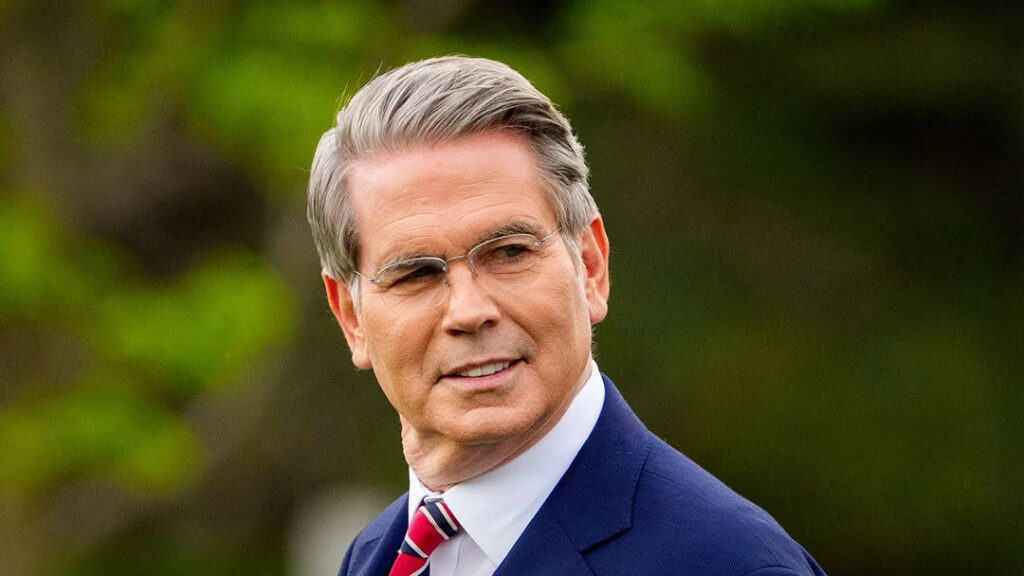

US Treasury Secretary Scott Bessent has linked the potential end of Russia’s war in Ukraine to European action against countries purchasing Russian oil.

Speaking in a joint interview with Reuters and Bloomberg on 15 September, Bessent said the conflict could conclude within 60 to 90 days if European nations imposed substantial secondary tariffs on Russian oil buyers because it would eliminate Moscow’s primary revenue source.

Bessent also stated that the Trump administration will not impose additional tariffs on Chinese goods to halt China’s Russian oil purchases unless European countries implement steep duties on China and India.

“We expect the Europeans to do their share now, and we are not moving forward without the Europeans,” he said.

Bessent’s comments follow President Donald Trump’s decision to impose an additional 25% tariff on Indian imports.

During talks with Chinese officials in Madrid focusing on trade and TikTok, Bessent said he informed them that the US had already imposed tariffs on Indian goods and that Trump has been urging European countries to impose tariffs of 50% to 100% on China and India.

The treasury secretary criticized European countries for continuing to purchase Russian oil directly or buying petroleum products refined in India from discounted Russian crude.

The treasury chief outlined next steps: stronger sanctions on Russian oil giants Rosneft and Lukoil, plus expanded use of the $300 billion in frozen Russian sovereign assets. Small seizures could start immediately, or the funds could serve as collateral for Ukrainian loans.

Meanwhile, Ukraine took matters into its own hands. Drone strikes in August eliminated four major Russian refineries, wiping out one-seventh of the country’s refining capacity. Gasoline prices surged 40-50% since January. Ukrainian forces also severed the Druzba pipeline, Russia’s main oil export route to Europe, cutting supplies to Hungary and Slovakia.