Vue normale

-

NYT > World News

-

It Isn’t Just the U.S. The Whole World Has Soured on Climate Politics.

How do we think about the climate future, now that the era marked by the Paris Agreement has so utterly disappeared?

-

NYT > U.S. News

-

California’s Environmental Past Confronts Economic Worries of the Present

Gov. Gavin Newsom and Democratic state lawmakers have focused on pocketbook concerns this year, seeing their party’s national losses as a reckoning.

California’s Environmental Past Confronts Economic Worries of the Present

© Loren Elliott for The New York Times

-

NYT > World News

-

Climate ‘Ideology’ Hurts Prosperity, Top U.S. Officials Tell Europeans

Chris Wright, the energy secretary, said he would push Europe to loosen environmental rules and buy more gas. Doug Burgum, the interior secretary, tied fossil fuels to a need to win the A.I. race.

Climate ‘Ideology’ Hurts Prosperity, Top U.S. Officials Tell Europeans

© Doug Mills/The New York Times

-

NYT > World News

-

Nuclear Sites Dotted Across Ukraine Pose Threat of Radiation Disaster

Each day of war risks a strike on sites that could scatter radioactive material. Officials say one laboratory near the front has been hit dozens of times.

Nuclear Sites Dotted Across Ukraine Pose Threat of Radiation Disaster

© David Guttenfelder/The New York Times

-

NYT > World News

-

China’s Renewable Energy Investment Helping Stem Fossil Fuel Growth, Report Says

Its vast investment in solar, wind and batteries is on track to end an era of global growth in the use of coal, oil and gas, the researchers said.

China’s Renewable Energy Investment Helping Stem Fossil Fuel Growth, Report Says

© Agence France-Presse — Getty Images

-

NYT > World News

-

Energy Secretary Attacks Offshore Wind and Dismisses Climate Change

Chris Wright, who travels to Europe next week to promote American gas, called climate change “not incredibly important.”

Energy Secretary Attacks Offshore Wind and Dismisses Climate Change

© Anna Moneymaker/Getty Images

-

Euromaidan Press

-

Trump “very unhappy” EU countries still buy Russian energy, Zelenskyy says

Ukrainian President Volodymyr Zelensky said during a September 5 briefing that US President Donald Trump expressed dissatisfaction with European countries continuing to purchase Russian gas and oil, thereby supporting Russia’s military machine. Hungary and Slovakia are among such countries, according to Zelensky. European Council President António Costa emphasized that the EU has already reduced purchases of Russian energy resources by 80%. A significant portion of the re

Trump “very unhappy” EU countries still buy Russian energy, Zelenskyy says

Ukrainian President Volodymyr Zelensky said during a September 5 briefing that US President Donald Trump expressed dissatisfaction with European countries continuing to purchase Russian gas and oil, thereby supporting Russia’s military machine. Hungary and Slovakia are among such countries, according to Zelensky.

European Council President António Costa emphasized that the EU has already reduced purchases of Russian energy resources by 80%. A significant portion of the remaining 20% falls on Hungary, which is currently blocking Ukraine’s EU accession.

Hungary explains this position by stating it disagrees with accepting Ukraine into the EU during wartime. But in that case, peace must be accelerated and the war stopped, Costa stressed.

“And for this it is necessary to continue supporting the Armed Forces of Ukraine, not to block the use of the Ukraine Facility fund. On the other hand, as President [of the US Donald] Trump said — it is very important to stop allowing the Russian Federation to continue waging this war by buying oil and gas,” Costa said.

Costa reported he will visit Hungarian Prime Minister Viktor Orban in the near future. President Zelensky also assured that contacts exist between Kyiv and Budapest.

Zelensky stated he sees no foundation for Hungary’s accusations but emphasized that Ukraine is ready for dialogue.

“We are ready to meet with Orban. To discuss what else they are dissatisfied with. And how else we can help so that they are finally satisfied. President Trump heard a signal from our side regarding the blockade. America and President Trump said they would work to unblock this process, to help Ukraine with this,” Zelenskyy said.

Costa emphasized that Ukraine must meanwhile continue working on EU accession.

“The negotiation process continues. Ukrainian authorities continue working with the European Commission. We cannot lose this path. We must continue working on reforms, because in any case this must be done. We don’t need to wait for Hungary, or anyone, to continue our work. Because Ukraine’s future is in the EU,” he said.

Costa believes the Russian-Ukrainian war will end before Ukraine’s EU accession negotiations conclude, so “there are no reasons to waste time in this process.”

“If even Putin does not object [to Ukraine’s EU membership], then the positions of some countries, especially Hungary, really look strange,” Zelenskyy said.

EU membership process

All 27 EU member states have given the “green light” to begin negotiations with Ukraine on joining the bloc, however, Hungary is blocking them.

Last year Budapest presented Ukraine with a list of 11 demands to unblock the path to the European Union. All are aimed at strengthening protection of national minority rights in Ukraine.

The Ukrainian side traveled to Budapest with additional proposals for resolving the entire complex of issues. Ukraine and Hungary then agreed from 12 May to organize regular consultations to work on the stated demands. However, Budapest postponed such consultations due to the Security Service of Ukraine’s detention of Hungarian spies in early May.

Hungarian authorities conducted a so-called consultative referendum in their country regarding Ukraine’s EU membership, based on which they announced that 95% of votes were against. Orban himself claimed that Ukraine’s EU membership would mean “destruction of the European Union” and war with Russia on EU territory.

Lithuania proposed starting negotiations with Ukraine and Moldova on the first chapter of EU membership without Hungary’s consent. It is proposed that after approval by 26 member states, negotiations would take place at a technical level, de facto, and later an official agreement would be reached legally when all 27 EU states approve it, if Viktor Orban’s position or that of the entire Hungarian government changes.

-

NYT > World News

-

Orsted Sues Trump Administration in Fight to Restart Its Blocked Wind Farm

The Danish company behind Revolution Wind, a $6 billion project off Rhode Island, said the federal government had unlawfully halted work on the wind farm.

Orsted Sues Trump Administration in Fight to Restart Its Blocked Wind Farm

© David Goldman/Associated Press

-

Euromaidan Press

-

How Ukraine went from power blackouts to selling electricity to Europe in record numbers

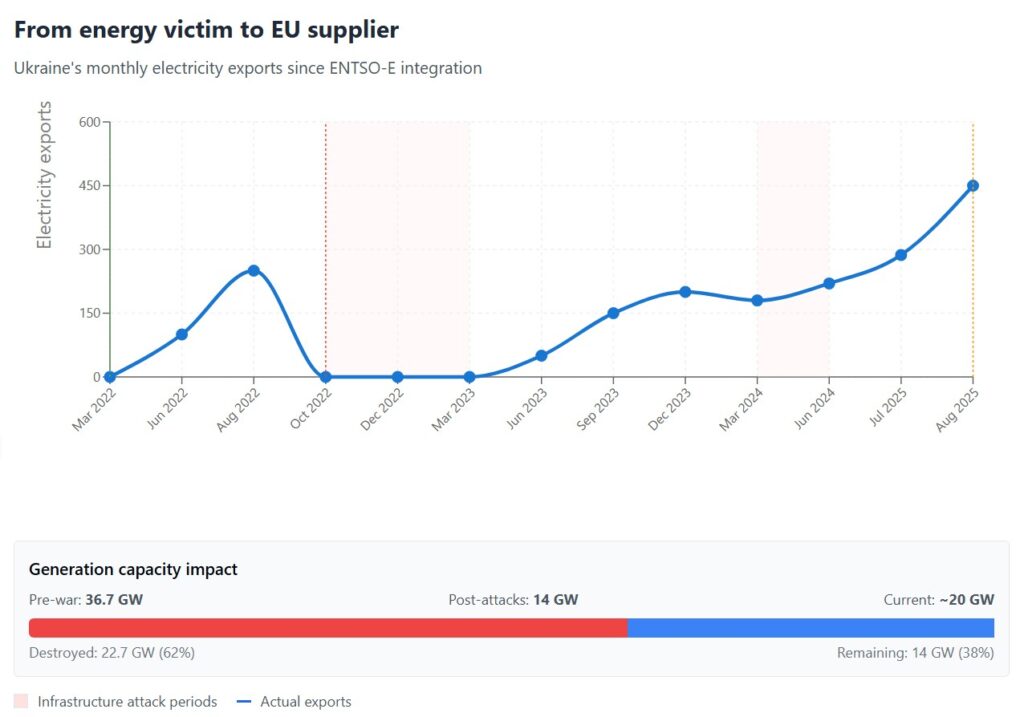

This represents a fundamental shift in Ukraine’s energy narrative, from vulnerability to strength, and maybe even regional dominance on the energy market one day. Ukraine is rapidly becoming a net energy exporter to Europe, with August 2025 exports reaching a record 450,000 MWh—the highest monthly figure since integration into the European Network of Transmission System Operators for Electricity (ENTSO-E) on 16 March 2022. The scale of this reversal is staggering.

How Ukraine went from power blackouts to selling electricity to Europe in record numbers

This represents a fundamental shift in Ukraine’s energy narrative, from vulnerability to strength, and maybe even regional dominance on the energy market one day.

Ukraine is rapidly becoming a net energy exporter to Europe, with August 2025 exports reaching a record 450,000 MWh—the highest monthly figure since integration into the European Network of Transmission System Operators for Electricity (ENTSO-E) on 16 March 2022.

The scale of this reversal is staggering. Just over a year ago, Russia’s systematic attacks destroyed 61% of its generation capacity.

The transformation showcases how Ukraine’s westernmost region is the launching pad for energy independence that could reshape European energy markets.

International volunteer experts are exploring large-scale distributed generation projects that could position Ukraine as Europe’s new low-cost electricity supplier.

Western regions lead the reconstruction model

Zakarpattia Oblast exemplifies this transformation. In spring 2025, regional officials met with Canadian volunteer engineers from “Technology United for Ukraine” to explore what could become billion-dollar distributed generation projects using gas turbine and hydrogen technologies.

The volunteer organization, led by president Brian Robinson, brings experienced engineers willing to conduct technical and economic feasibility studies and attract donors for distributed generation development—expertise that traditional consulting firms hesitate to provide in active war zones.

But Zakarpattia’s energy ambitions extend beyond meetings.

The region already hosts Ukraine’s only multi-megawatt wind turbine production facility, launched by Friendly Wind Technology in May 2024, capable of producing up to 20 wind turbines annually ranging from 4.8 to 5.5 megawatts.

More ambitious still is the planned 1.5-gigawatt hydrogen valley project, featuring an initial 100 MW electrolyser capacity powered by 120 MW solar and 80-160 MW wind installations. Operations are expected to start in 2035.

Geography drives strategy

Zakarpattia’s location makes it ideal for Ukraine’s energy export ambitions.

Positioned hundreds of kilometers from active combat zones, the region offers the relative safety that major infrastructure projects require.

At the same time, its borders with Hungary and Slovakia provide direct pipelines into European energy markets.

Ukrainian workforce and production costs could make electricity produced here competitive across Central Europe, positioning the country to replace Russia as the continent’s energy supplier.

This would help the EU simultaneously overcome Russian and fossil fuel dependency.

From defense to export strategy

Ukraine’s energy transformation, already well underway, follows a clear strategic evolution. State power operator Ukrenergo declared more than a year ago that decentralizing electricity production through hundreds of small power plants was the only way to protect against Russian attacks.

The export numbers show that what began as a defensive necessity is turning into an offensive economic strategy.

Volunteer expertise fills the gap

Here is also where the Canadian engineers come into play. Their involvement in Zakarpattia reflects a broader pattern in Ukraine’s reconstruction: specialized technical assistance increasingly comes from unexpected sources as traditional institutions remain cautious about active war zone operations.

“Such potentially rapid solutions will increase the region’s energy potential and strengthen the national energy system,” regional officials commented after the spring discussions.

“This is not only about energy independence, but also about attracting investment and creating new jobs.”

The volunteer-driven approach offers advantages beyond mere expertise. Unlike commercial consultants, volunteer organizations can focus purely on technical feasibility and donor attraction without commercial constraints that complicate larger institutional projects.

What needs to happen next

For Ukraine’s west to fulfill its potential as an energy export hub, several elements must align.

Feasibility studies like those proposed for Zakarpattia need completion and implementation; international financing must move from discussion to commitment; projects require seamless connection to European grid systems, and individual regional projects should complement rather than compete.

The success of initiatives like the Zakarpattia hydrogen valley and distributed generation projects will determine whether Ukraine’s western regions become mere reconstruction examples or strategic economic centers driving the country’s post-war prosperity.

Early indicators suggest international confidence in the region’s potential.

If volunteer feasibility studies successfully attract the donors they target, Ukraine’s west could emerge as the launching pad for energy independence, transforming Ukraine from a Russian energy victim into Europe’s new electricity supplier.

-

NYT > World News

-

Years After Japan’s Nuclear Disaster, People With Cancer Seek Answers

A survey has found hundreds of thyroid tumors, but Japanese officials say they are unrelated to the Fukushima meltdowns. Now they face a lawsuit.

Years After Japan’s Nuclear Disaster, People With Cancer Seek Answers

© Ko Sasaki for The New York Times

-

Euromaidan Press

-

Russia is turning Ukraine’s Zaporizhzhia plant into nuclear weapon with offering “joint control” over facility, says Kyiv

Russia is turning the Zaporizhzhia Nuclear Plant into a nuclear weapon. Any attempt by Moscow to impose new forms of control over the facility constitutes a direct escalation of nuclear security threats for both Ukraine and Europe, the Ministry of Energy of Ukraine has warned. The Zaporizhzhia Nuclear Power Plant (ZNPP), the largest in Europe, has been occupied since 2022. It has enough capacity to cover the annual electricity needs of countries like Ireland, Slovakia, o

Russia is turning Ukraine’s Zaporizhzhia plant into nuclear weapon with offering “joint control” over facility, says Kyiv

Russia is turning the Zaporizhzhia Nuclear Plant into a nuclear weapon. Any attempt by Moscow to impose new forms of control over the facility constitutes a direct escalation of nuclear security threats for both Ukraine and Europe, the Ministry of Energy of Ukraine has warned.

The Zaporizhzhia Nuclear Power Plant (ZNPP), the largest in Europe, has been occupied since 2022. It has enough capacity to cover the annual electricity needs of countries like Ireland, Slovakia, or Finland.

Putin floats “cooperation” on ZNPP

On 2 September in Beijing, during a meeting with Slovak Prime Minister Robert Fico, Russian President Vladimir Putin suggested that “under favorable circumstances, Russia, the US, and Ukraine could cooperate at the Zaporizhzhia NPP.”

Ministry of Energy: plant occupied and in peril

Ukraine’s Ministry of Energy stresses that Russia seized the civilian nuclear facility by force and continues to block legitimate Ukrainian control.

“Russia attacked with heavy military equipment and occupied Ukraine’s civilian nuclear facility, the Zaporizhzhia Nuclear Power Plant,” it claims.

The ministry emphasizes that the plant is operating under an extraordinary threat scenario, unanticipated by design standards or international safety frameworks.

Dangerous shutdowns and risk of disaster

Since the occupation began, Russia has caused “systemic, critically dangerous deformations” at the site.

This includes the destruction of the Kakhovka dam, which eliminated the primary water source for cooling reactors, and nine full disconnections from Ukraine’s power grid.

“These are direct preconditions for a nuclear accident,” the ministry warns.

Call for international action

Kyiv views Putin’s remarks on new maintenance models at ZNPP as an attempt to turn the plant into a military tool.

“Ukraine calls on the international community to provide a clear assessment of these statements and actions, given their potential impact on the security of the entire European continent,” the ministry stressed.

Ukraine will raise the issue at the September session of the International Atomic Energy Agency General Conference (IAEA) and urge global condemnation of Russia’s actions.

IAEA denied access to a new dam

On 31 August, IAEA Director Rafael Grossi said that Russia did not allow the organization’s inspectors to access the new dam that the occupiers built near the plant, according to Sky News.

“Our access to this dam is essential to assess the cooling water situation which is crucial given the fragile nuclear safety situation at the ZNPP,” he said.

He added that the problem is further complicated by the fact that the ZNPP currently relies on a single external power line to supply electricity to the plant’s safety systems, while the plant itself is not producing power.

-

Euromaidan Press

-

Putin has just created alibi for himself at Shanghai summit for killing over 13,800 Ukrainian civilians

Russian President Vladimir Putin is once again lying about strikes on Ukraine. During a meeting with Slovak Prime Minister Robert Fico at the summit in China, he claimed that Russia’s massive attacks were in response to Ukrainian assaults on Russian energy facilities, according to the pro-Kremlin outlet RIA Novosti. From the first day of the all-out war, terrorism against Ukrainian civilians has been Russia’s main target and method of war. From the massacre in Bucha, the

Putin has just created alibi for himself at Shanghai summit for killing over 13,800 Ukrainian civilians

Russian President Vladimir Putin is once again lying about strikes on Ukraine. During a meeting with Slovak Prime Minister Robert Fico at the summit in China, he claimed that Russia’s massive attacks were in response to Ukrainian assaults on Russian energy facilities, according to the pro-Kremlin outlet RIA Novosti.

Putin justifies attacks on energy infrastructure

“Moscow endured Ukrainian strikes on Russian energy for a long time, and then began to respond seriously,” Putin said.

Meanwhile, Andrii Kovalenko, head of Ukraine’s Center for Countering Disinformation, calls his statements a blatant lie, as since 2022, Russia has systematically attacked Ukraine’s energy infrastructure, especially during the preparation for winter and in winter itself.

Attacks on civilians continue

Once again, he tried to shift the responsibility for Russian aggression onto Ukraine, explained Kovalenko.

“Putin is preparing an informational alibi for strikes on Ukrainian energy. In Beijing, he claimed that Russia ‘never hit energy’ and only responds to Ukrainian attacks on the oil sector. This is false,” he stressed.

Kovalenko added that the Russians strike during the lead-up to winter and directly in winter. This year, they also did not stop attacks on energy in regions bordering Russia.

Kremlin information operation

According to Kovalenko, Putin’s speech in Beijing is part of another Russian information operation aimed at the West and the Global South.

“It is an attempt to shift responsibility for terrorizing Ukrainians onto us,” he claimed.

The Russians were the ones who started the war and attacks on energy, and they have never stopped.

According to the UN, Russia’s war has killed more than 13,800 civilians in Ukraine. Attacks on Ukraine intensified, particularly in 2025, following the launch of peace initiatives by US President Donald Trump.

Russia was not punished with sanctions or any other measures. On the contrary, President Putin was invited to a meeting with Trump in Alaska.

Putin urges Europe to weaponize energy against Ukraine, praises Trump’s inaction

Also, during the meeting with Fico, Putin called “on his friends in Europe” to cut Ukraine’s fuel and electricity supplies, the Kremlin press service reports. The Russian ruler emphasized that Ukraine receives a significant amount of energy resources through its Eastern European neighbors.

“Shut off their gas supplies, shut off their electricity supplies, and they will immediately understand that there are limits to violating others’ interests,” Putin said in a conversation with Robert Fico.

He also praised the administration of US President Donald Trump, which refused to provide free aid to Ukraine and introduced no new sanctions against Russia. According to Putin, under Trump, America began to “listen to Russia,” a claim he said was confirmed by the Alaska summit.

-

NYT > World News

-

Transportation Dept. Cancels $679 Million for Offshore Wind Projects

The Trump administration’s campaign against wind power continued as it targeted funding for marine terminals and ports to support development of the industry.

Transportation Dept. Cancels $679 Million for Offshore Wind Projects

© Carolyn Kaster/Associated Press

-

NYT > World News

-

A Casualty of Trump’s Tariffs: India’s Nascent Solar Industry

The full weight of a 50 percent tariff on Indian goods took effect this week, undercutting one of the country’s most promising markets for solar exports.

A Casualty of Trump’s Tariffs: India’s Nascent Solar Industry

© Saumya Khandelwal for The New York Times

-

NYT > World News

-

After Blocking U.N. Nuclear Watchdog, Iran Allows Inspectors to Return

Iran halted cooperation with the agency last month, as experts warned that Tehran might revive efforts to build a nuclear bomb.

After Blocking U.N. Nuclear Watchdog, Iran Allows Inspectors to Return

© Planet Labs

-

NYT > World News

-

Trump, With Tariffs and Threats, Tries to Strong-Arm Nations to Retreat on Climate Goals

The president has made no secret of his distaste for wind and solar in America. Now he’s taking his fossil fuel agenda overseas.

Trump, With Tariffs and Threats, Tries to Strong-Arm Nations to Retreat on Climate Goals

© Tierney L. Cross/The New York Times

-

Euromaidan Press

-

Russian drones target civilian energy infrastructure across six Ukrainian regions causing power outages

Russian forces conducted extensive attacks on Ukraine’s energy and gas transport infrastructure during the night of 26-27 August, affecting six regions across the country. Russia has systematically targeted Ukraine’s energy infrastructure since late 2022 as a strategic weapon to weaken civilian morale, disrupt the economy, and pressure Ukraine toward favorable political concessions. The campaign focuses on power plants, electrical transformers, gas facilities, and transmission networks to create

Russian drones target civilian energy infrastructure across six Ukrainian regions causing power outages

Russian forces conducted extensive attacks on Ukraine’s energy and gas transport infrastructure during the night of 26-27 August, affecting six regions across the country.

The strikes targeted facilities in Sumy, Poltava, Donetsk, Chernihiv, Kharkiv, and Zaporizhzhia oblasts using drones, according to Ukraine’s Ministry of Energy.

The attacks focused specifically on civilian infrastructure, with emergency and rescue services currently working at impact sites while damage assessments continue.

In northeastern Sumy, located near the border with Russia, a key electrical substation sustained damage around 1 a.m., resulting in power outages across significant portions of the city and affecting industrial consumers. The attack also disrupted the city’s water supply system, forcing all water utility facilities to switch to emergency backup power.

Central Poltava Oblast experienced strikes against gas transport infrastructure facilities, causing substantial damage to the regional gas network. Energy and gas workers are currently working to restore services as quickly as possible.

Ukrainian officials characterized the attacks as “another act of energy terrorism aimed at the civilian population” and part of what they called Russia’s deliberate strategy to destroy civilian infrastructure ahead of the upcoming heating season.

The most severe period of Russian attacks on Ukrainian energy infrastructure occurred during winter 2024. Russia launched large-scale assaults on thermal power plants and heating systems. Cities like Kyiv and Kharkiv experienced prolonged rolling blackouts affecting both residential areas and industrial operations during the harshest weather conditions in winter.

Ukraine’s energy situation has partially stabilized in 2025 through infrastructure repairs and increased electricity imports from Europe, with nuclear power now serving as the backbone of the system. However, the network remains vulnerable to periodic strikes, as demonstrated by the recent August attacks on Sumy and Poltava oblasts.

-

Euromaidan Press

-

EU’s new Russian sanctions package will not be as expected

The European Union is developing new sanctions to increase pressure on Russia’s weak war economy, Politico reports. However, the upcoming measures will not target Russian energy sales, which continue to finance Moscow’s war against Ukraine. Focus on “shadow fleet” and sanctions evasion European diplomats say the 19th package, expected next month, will target ships of the “shadow fleet” and companies helping Russia bypass existing sanctions. The Russian “shadow fleet” consists of grey-market tan

EU’s new Russian sanctions package will not be as expected

The European Union is developing new sanctions to increase pressure on Russia’s weak war economy, Politico reports. However, the upcoming measures will not target Russian energy sales, which continue to finance Moscow’s war against Ukraine.

Focus on “shadow fleet” and sanctions evasion

European diplomats say the 19th package, expected next month, will target ships of the “shadow fleet” and companies helping Russia bypass existing sanctions.

The Russian “shadow fleet” consists of grey-market tankers that evade international sanctions. These tankers often sail with transponders turned off, without proper insurance, and conceal their identities. This fleet channels Russian oil exports to China, India, and Global South countries, helping Moscow fund its war. Shutting down this corridor, through port controls and insurance restrictions, could deal a serious blow to the Kremlin’s energy revenues.

Secondary sanctions against firms or countries doing business with Moscow could have the greatest impact, but their effectiveness will depend on US cooperation.

US pressure and Trump’s role

Experts note that Russian President Vladimir Putin agreed to talks with US President Donald Trump in Alaska after the US imposed high tariffs on India for buying Russian oil. Next steps could include tighter restrictions on Russia-China trade. Trump hinted at possible “massive sanctions or tariffs” if Moscow does not support peace negotiations.

EU constraints and upcoming summit

“We don’t expect there will be much room for any material Russian oil sanctions in the EU’s 19th sanctions package,” said ICIS analyst Ajay Parmar.

EU foreign ministers will meet at an informal summit later this week to discuss additional economic measures. While Slovakia and Hungary oppose expanding sanctions, diplomats are confident a unified stance can be achieved.

-

Euromaidan Press

-

US-Russia energy deals floated as incentives for Ukraine peace talks: Reuters

US and Russian officials discussed energy deals between the two countries during multiple rounds of talks in August, Reuters reports, citing sources familiar with the talks. The deals were presented as incentives for Russia to agree to a peace deal with Ukraine and for the US to ease sanctions on Russia. The discussions reportedly took place during US envoy Steve Witkoff’s visit to Moscow on 6 August, and again briefly during the Trump-Putin summit in Alaska on 15 August. “The White House rea

US-Russia energy deals floated as incentives for Ukraine peace talks: Reuters

US and Russian officials discussed energy deals between the two countries during multiple rounds of talks in August, Reuters reports, citing sources familiar with the talks.

The deals were presented as incentives for Russia to agree to a peace deal with Ukraine and for the US to ease sanctions on Russia.

The discussions reportedly took place during US envoy Steve Witkoff’s visit to Moscow on 6 August, and again briefly during the Trump-Putin summit in Alaska on 15 August.

“The White House really wanted to put out a headline after the Alaska summit, announcing a big investment deal,” one of the sources said, according to Reuters.

Western sanctions have left Russia largely cut off from international investment and cooperation in the energy sector since the country’s full-scale invasion of Ukraine in 2022.

Russia seeks Exxon return and US equipment access

Three major deals could restore Russia’s energy lifelines following years of sanctions:

- US energy company Exxon Mobil re-entering Russia’s Sakhalin-1 oil and gas project;

- Russia purchasing US equipment for LNG projects, including Arctic LNG 2, which is under western sanctions;

- US purchasing Russian nuclear-powered icebreaker vessels.

On the same day as the Alaska summit, Putin signed a decree opening up the Sakhalin-1 project to foreign investment. Exxon exited Russia in 2022 following the invasion of Ukraine, abandoning its 30% share in the Sakhalin-1 project.

One of the sources also said that the US wants Russia to rely more on US technology, rather than Chinese, in an effort to weaken Russia-China relations.

Trump diplomacy mixes peace talks with financial incentives

Trump and his national security team are engaging with Russian and Ukrainian officials to end the war, a White House official told Reuters in response to questions about the deals. They declined to further discuss the deals publicly.

The 6 August meeting between Witkoff and Putin was the final round of talks before President Trump’s “deadline” for agreeing to a peace deal, for which he threatened heavier sanctions on Russia.

The 15 August meeting between the US and Russian presidents was the highest-level diplomatic forum since the beginning of the full-scale Russian invasion of Ukraine in 2022. The stated goal of the American side was to negotiate a peace deal between Ukraine and Russia.

-

The Kyiv Independent

-

Russia's crude exports fall to lowest level since February

Russia's crude oil shipments have dropped to their lowest level since February, as refinery processing outpaces production growth and trims available export volumes, Bloomberg reported on July 8.Russia has used its revenues from energy exports to finance the war in Ukraine.Seaborne crude flows averaged 3.12 million barrels a day over the four weeks to July 6, a 3% decline from the previous period ending June 29, according to tanker-tracking data compiled by Bloomberg. That's the lowest level rec

Russia's crude exports fall to lowest level since February

Russia's crude oil shipments have dropped to their lowest level since February, as refinery processing outpaces production growth and trims available export volumes, Bloomberg reported on July 8.

Russia has used its revenues from energy exports to finance the war in Ukraine.

Seaborne crude flows averaged 3.12 million barrels a day over the four weeks to July 6, a 3% decline from the previous period ending June 29, according to tanker-tracking data compiled by Bloomberg. That's the lowest level recorded since the four-week period ending Feb. 23.

The gross value of Moscow's oil exports rose by about $100 million, or 8%, to $1.36 billion for the week ending July 6, Bloomberg said. That increase was due to higher volume, although average export prices declined for a second consecutive week.

Most of Russia's oil continues to head to Asia. Shipments to the region averaged 2.73 million barrels per day, slightly lower than the previous month. Flows to Turkey fell to 370,000 barrels a day, and shipments to Syria held steady at 25,000 barrels a day.

The European Union is seeking to tighten sanctions on Russia. Ambassadors have yet to approve the EU's 18th sanctions package due to opposition from Hungary and Slovakia. The bloc failed to adopt the new package on June 27.

The new package includes restrictions targeting Russia's energy and banking sectors, as well as transactions linked to the Nord Stream gas pipeline.

The Kyiv IndependentTim Zadorozhnyy

The Kyiv IndependentTim Zadorozhnyy

-

The Kyiv Independent

-

Lavrov meets Iranian counterpart Abbas Araqchi at BRICS summit, reiterates Russia's offer to mediate disputes over nuclear program

Russian Foreign Minister Sergey Lavrov reiterated Moscow's offer to mediate disputes over Iran’s nuclear program, during a meeting with his Iranian counterpart at the BRICS summit in Rio de Janeiro, Reuters reported on July 6.Lavrov met with Iranian Deputy Foreign Minister Abbas Araqchi to discuss the situation, condemning recent Israeli and U.S. strikes on Iran, including attacks on nuclear sites under IAEA safeguards. Moscow reaffirmed its support for Iran’s right to nuclear energy, and also o

Lavrov meets Iranian counterpart Abbas Araqchi at BRICS summit, reiterates Russia's offer to mediate disputes over nuclear program

Russian Foreign Minister Sergey Lavrov reiterated Moscow's offer to mediate disputes over Iran’s nuclear program, during a meeting with his Iranian counterpart at the BRICS summit in Rio de Janeiro, Reuters reported on July 6.

Lavrov met with Iranian Deputy Foreign Minister Abbas Araqchi to discuss the situation, condemning recent Israeli and U.S. strikes on Iran, including attacks on nuclear sites under IAEA safeguards.

Moscow reaffirmed its support for Iran’s right to nuclear energy, and also offered to store Iranian uranium as part of a potential solution.

Although Iran officially denies intentions to pursue nuclear weapons, tensions with the U.S. and Israel remain high following the Iran-Israel conflict in June, which has currently settled into an uncertain ceasefire.

Ukraine’s Foreign Ministry said on June 22 that Iran’s nuclear program must be dismantled to prevent it from threatening the Middle East or the wider world, following U.S. air strikes on Iranian nuclear facilities.

“Iran is complicit in the crime of aggression against Ukraine. The Iranian regime is providing military assistance to Russia, including the supply of UAVs and technologies that Russia consistently uses to kill people and destroy critical infrastructure,” the statement read.

Russia and Iran have deepened ties since the start of the full-scale invasion. Notably, Iran has provided Russia with thousands of Shahed drones used in attacks against Ukrainian cities, as well as short-range ballistic missiles.

The Kyiv IndependentMartin Fornusek

The Kyiv IndependentMartin Fornusek

-

The Kyiv Independent

-

Trump envoy Steve Witkoff pushing to lift energy sanctions on Russia, Politico reports

U.S. President Donald Trump's Special Envoy Steve Witkoff is pushing to lift U.S. energy sanctions on Russia, Politico reported on July 4, citing two people familiar with the matter. The move is part of a broader debate within Trump's administration over how to engage with Moscow amid the ongoing war in Ukraine.While Witkoff is reportedly advocating for the easing of energy sanctions, others in the administration disagree. Interior Secretary Doug Burgum favors reducing U.S. reliance on Russian i

Trump envoy Steve Witkoff pushing to lift energy sanctions on Russia, Politico reports

U.S. President Donald Trump's Special Envoy Steve Witkoff is pushing to lift U.S. energy sanctions on Russia, Politico reported on July 4, citing two people familiar with the matter.

The move is part of a broader debate within Trump's administration over how to engage with Moscow amid the ongoing war in Ukraine.

While Witkoff is reportedly advocating for the easing of energy sanctions, others in the administration disagree. Interior Secretary Doug Burgum favors reducing U.S. reliance on Russian imports rather than expanding trade, according to Politico.

Despite pledging during his campaign to end the war in Ukraine in "24 hours," Trump has made little progress on securing a ceasefire. After nearly seven months of his presidency, and several peace talks between Russia, Ukraine, and the United States, no ceasefire agreement has been reached.

Moscow continues intensifying its attacks against Ukrainian cities. Russia launched one of the largest aerial attacks on Ukraine on July 4, hours after Russian President Vladimir Putin had a phone conversation with Trump.

When journalists asked if he had made any progress with Putin on the call, Trump responded: "No, I didn't make any progress with him today at all."

Europe's energy sector is a central issue in the debate. According to Politico, Moscow is in early talks with Washington about potentially restarting the Nord Stream pipeline project, with backing from U.S. investors. The development has sparked concern in Brussels.

One senior EU official reportedly warned that Trump and Putin appear to be aiming to "divide the European energy market and create (separate) spheres of influence."

Witkoff, a real estate developer-turned-envoy, has raised eyebrows in Washington and abroad over his handling of high-level talks with Russia. As reported by NBC News in May, he has relied on Kremlin-provided translators during multiple meetings with Putin, including a visit to Moscow on April 26, just a day after a Russian missile attack killed 12 people in Kyiv.

Trump's administration has so far refrained from imposing new sanctions against Russia, even as Putin continues to reject calls for a ceasefire.

The Kyiv IndependentThe Kyiv Independent news desk

The Kyiv IndependentThe Kyiv Independent news desk

-

The Kyiv Independent

-

Russia's Rosatom seeks to sell 49% stake in Turkey's first nuclear plant

Russian nuclear giant Rosatom is negotiating the sale of a 49% stake in Turkey's Akkuyu Nuclear Power Plant project, estimated at $25 billion, Bloomberg reported on July 1.The project is a cornerstone of Russian-Turkish energy cooperation. The Akkuyu plant, located in Mersin Province, is poised to become Turkey's first nuclear power facility. The 4.8-gigawatt project is expected to begin supplying electricity in 2026, Anton Dedusenko, chairman of the board at Rosatom's Turkish subsidiary, told B

Russia's Rosatom seeks to sell 49% stake in Turkey's first nuclear plant

Russian nuclear giant Rosatom is negotiating the sale of a 49% stake in Turkey's Akkuyu Nuclear Power Plant project, estimated at $25 billion, Bloomberg reported on July 1.

The project is a cornerstone of Russian-Turkish energy cooperation. The Akkuyu plant, located in Mersin Province, is poised to become Turkey's first nuclear power facility.

The 4.8-gigawatt project is expected to begin supplying electricity in 2026, Anton Dedusenko, chairman of the board at Rosatom's Turkish subsidiary, told Bloomberg.

"The closer we are to the first unit generating electricity, the more investors start coming," Dedusenko said on the sidelines of the Nuclear Power Plants Expo & Summit in Istanbul.

A previous sale attempt in 2018 collapsed over commercial disagreements. This time, financing is complicated by the threat of U.S. sanctions, prompting Moscow and Ankara to consider alternative payment mechanisms.

"There are many ways how to deliver money here. We can deliver the Russian rubles, the Turkish lira," Dedusenko said.

Despite its NATO membership, Turkey has maintained open diplomatic and economic ties with Russia throughout the full-scale war against Ukraine, while continuing to supply aid to Kyiv and host international mediation efforts.

The Kyiv IndependentDaria Shulzhenko

The Kyiv IndependentDaria Shulzhenko

-

The Kyiv Independent

-

Ukraine's power exports surge 2.5 times, recovering to pre-Russian attack levels

Ukraine boosted electricity exports by 150% in June 2025 compared to the previous month, reaching over 237,000 megawatt-hours (MWh), according to consulting firm ExPro Electricity.Current export volumes have returned to autumn 2022 levels, before Russia launched systematic attacks against Ukraine's energy infrastructure that caused massive blackouts across the country.This marks Ukraine's return to exporting more electricity than it imports for the first time since October 2023, ExPro analysis r

Ukraine's power exports surge 2.5 times, recovering to pre-Russian attack levels

Ukraine boosted electricity exports by 150% in June 2025 compared to the previous month, reaching over 237,000 megawatt-hours (MWh), according to consulting firm ExPro Electricity.

Current export volumes have returned to autumn 2022 levels, before Russia launched systematic attacks against Ukraine's energy infrastructure that caused massive blackouts across the country.

This marks Ukraine's return to exporting more electricity than it imports for the first time since October 2023, ExPro analysis reports.

Electricity cannot be stored in large volumes for long periods, so it can be exported during certain hours when there is surplus in Ukraine’s energy system, and imported during deficit hours.

Hungary imported the majority of Ukrainian exports, with shipments jumping from 34,000 to 122,000 MWh in a single month.

The recovery represents a dramatic turnaround from June 2024, when Ukraine had no exports at all and imported 858,000 MWh, four times more than in June 2025.

Russia continues to target Ukraine's energy infrastructure, with the latest strike hitting a critical energy facility in Kherson Oblast on June 27 that caused widespread blackouts across multiple communities.

Governor Oleksandr Prokudin warned residents to prepare for prolonged outages as power engineers work to restore electricity, saying "Russia decided to plunge Kherson Oblast into darkness."

In February 2025, Emergency energy power shutdowns were introduced in eight Ukrainian oblasts due to Russian attacks on the country's energy system.

The Kyiv IndependentAnna Fratsyvir

The Kyiv IndependentAnna Fratsyvir

-

The Kyiv Independent

-

Russian attack on key energy facility plunges parts of southern Ukraine 'into darkness,' governor says

Russian forces struck a critical energy facility in Kherson Oblast, causing widespread power outages across several communities, Governor Oleksandr Prokudin said on June 27."Russia decided to plunge Kherson Oblast into darkness," Prokudin wrote on Telegram. He said the attack has disrupted electricity supply to multiple settlements.Local power engineers are working to stabilize the situation, Prokudin said. "I ask the residents of the region to prepare for a prolonged power outage. Power enginee

Russian attack on key energy facility plunges parts of southern Ukraine 'into darkness,' governor says

Russian forces struck a critical energy facility in Kherson Oblast, causing widespread power outages across several communities, Governor Oleksandr Prokudin said on June 27.

"Russia decided to plunge Kherson Oblast into darkness," Prokudin wrote on Telegram. He said the attack has disrupted electricity supply to multiple settlements.

Local power engineers are working to stabilize the situation, Prokudin said.

"I ask the residents of the region to prepare for a prolonged power outage. Power engineers are doing everything possible to stabilize the situation," he said.

Kherson and the surrounding regions have frequently come under Russian fire since Ukrainian forces liberated the city from occupation in November 2022. Russian troops continue to attack the area with artillery and drones from across the Dnipro River.

The Russian army consistently targeted Ukrainian energy infrastructure. Throughout 2024, Moscow launched 13 mass attacks with drones and missiles on Ukraine's energy infrastructure. Ukraine was forced to introduce emergency blackouts across the country.

Ukraine and Russia agreed to a partial 30-day energy truce, following consultations with the U.S. in Riyadh on March 25. Moscow violated the ceasefire more than 30 times, Foreign Ministry Spokesperson Heorhii Tykhyi said on April 16.

The Kyiv IndependentKollen Post

The Kyiv IndependentKollen Post

-

The Kyiv Independent

-

Strikes didn’t destroy Iran’s nuclear sites, US intel finds, contradicting Trump, CNN reports

Recent U.S. strikes on three Iranian nuclear facilities did not eliminate the core components of Tehran’s nuclear program and likely delayed it by only a few months, according to an early assessment by the U.S. Defense Intelligence Agency (DIA), CNN reported on June 24, citing four sources familiar with the findings.The analysis, based on a battle damage report from U.S. Central Command, contradicts public statements by President Donald Trump and Defense Secretary Pete Hegseth, who claimed the o

Strikes didn’t destroy Iran’s nuclear sites, US intel finds, contradicting Trump, CNN reports

Recent U.S. strikes on three Iranian nuclear facilities did not eliminate the core components of Tehran’s nuclear program and likely delayed it by only a few months, according to an early assessment by the U.S. Defense Intelligence Agency (DIA), CNN reported on June 24, citing four sources familiar with the findings.

The analysis, based on a battle damage report from U.S. Central Command, contradicts public statements by President Donald Trump and Defense Secretary Pete Hegseth, who claimed the operation had "obliterated" Iran’s nuclear capabilities.

"So the (DIA) assessment is that the U.S. set them back maybe a few months, tops," one source told CNN, adding that Iran’s stockpile of enriched uranium was not destroyed and that most centrifuges remain “intact.”

The White House acknowledged the assessment’s existence but strongly dismissed it. "This alleged assessment is flat-out wrong and was classified as ‘top secret’ but was still leaked to CNN by an anonymous, low-level loser in the intelligence community," press secretary Karoline Leavitt said. “The leaking of this alleged assessment is a clear attempt to demean President Trump, and discredit the brave fighter pilots who conducted a perfectly executed mission to obliterate Iran’s nuclear program. Everyone knows what happens when you drop fourteen 30,000 pound bombs perfectly on their targets: total obliteration.”

Trump, for his part, stood by his assessment of the mission's success. “I think it’s been completely demolished,” he said on Tuesday. “Those pilots hit their targets. Those targets were obliterated, and the pilots should be given credit.” Asked if Iran could rebuild, Trump responded: “That place is under rock. That place is demolished.”

While both Trump and Hegseth praised the strikes as decisive, others expressed caution. Chairman of the Joint Chiefs of Staff Dan Caine said it was “way too early” to determine whether Iran retained nuclear capabilities.

Republican Rep. Michael McCaul, former chair of the House Foreign Affairs Committee, also avoided endorsing the president’s characterization. “I’ve been briefed on this plan in the past, and it was never meant to completely destroy the nuclear facilities, but rather cause significant damage,” McCaul told CNN. “But it was always known to be a temporary setback.”

The DIA’s assessment reportedly found that damage at the Fordow, Natanz, and Isfahan sites was mostly limited to aboveground infrastructure, such as power systems and uranium metal processing buildings. The underground facilities—where Iran's most sensitive nuclear work takes place—were largely unaffected, the sources said.

According to CNN, Israel had been carrying out its own strikes on Iranian nuclear facilities prior to the U.S. operation, but relied on U.S. B-2 bombers equipped with 30,000-pound “bunker buster” bombs to finish the job. Despite over a dozen bombs being dropped on Fordow and Natanz, the sites’ key components remain intact, the sources said.

The U.S. also reportedly used Tomahawk missiles launched from a submarine to target Isfahan, rather than deploying bunker busters. A source said this was due to doubts over whether the bombs could penetrate Isfahan’s deep underground levels, which are believed to be even more fortified than Fordow.

Two sources also told CNN that Iran likely retains undisclosed nuclear facilities that were not targeted and remain operational.

Meanwhile, classified briefings for lawmakers on the strikes were postponed. The all-Senate briefing was rescheduled for Thursday, and the House briefing’s new date remains unclear.

The Kyiv IndependentAndrew Chakhoyan

The Kyiv IndependentAndrew Chakhoyan

-

The Kyiv Independent

-

Ukraine state grid operator appoints CEO after 10-month vacancy, Ukrainian media report

Ukrainian state grid operator Ukrenergo's supervisory board has appointed Vitaliy Zaichenko, the company's current chief dispatcher, as its new head, Ukrainian media reported on June 23. The appointment comes after ten months of interim leadership following the controversial dismissal of former CEO Volodymyr Kudrytskyi in September 2024.The company has been under temporary management of Oleksiy Brekht while the supervisory board struggled with prolonged disputes over the selection process.Ukrene

Ukraine state grid operator appoints CEO after 10-month vacancy, Ukrainian media report

Ukrainian state grid operator Ukrenergo's supervisory board has appointed Vitaliy Zaichenko, the company's current chief dispatcher, as its new head, Ukrainian media reported on June 23.

The appointment comes after ten months of interim leadership following the controversial dismissal of former CEO Volodymyr Kudrytskyi in September 2024.

The company has been under temporary management of Oleksiy Brekht while the supervisory board struggled with prolonged disputes over the selection process.

Ukrenergo, which operates Ukraine's electricity transmission system and is a member of the European electricity grid network (ENTSO-E), plays a critical role in the country's energy security, especially during wartime when Russian attacks have repeatedly targeted energy infrastructure.

Zaichenko beat out two other finalists: Oleksiy Brekht, the interim head of Ukrenergo, and Ivan Yuryk, former acting head of Ukrainian Railways.

The supervisory board's June 4 attempt to elect a new CEO failed amid conflict with the Energy Ministry, which changed appointment rules without consulting the Energy Community Secretariat, drawing criticism from European partners.

The new rules complicated the selection process by requiring five out of seven supervisory board votes instead of the previous four needed to elect a chairman.

According to Ukrainian MP Max Khlapuk, the European Bank for Reconstruction and Development (EBRD) threatened to block 141 million euros ($152 million) in funding and demand early repayment of 533 million euros ($574 million) already received over the rule changes.

Former Ukrenergo CEO Volodymyr Kudrytskyi was dismissed on Sept.2, 2024, after President Volodymyr Zelensky called for his resignation over alleged failures to protect substations from Russian missiles and drones.

Kudrytskyi disputed this account, saying he initiated the supervisory board meeting himself, though he did not reveal the reasons for his dismissal.

Following Kudrytskyi's dismissal, supervisory board chairman Daniel Dobbeni and member Peder Andersen resigned early, citing political pressure in personnel decisions.

The Kyiv IndependentYana Prots

The Kyiv IndependentYana Prots

-

The Kyiv Independent

-

Ukrainian energy giant to build $115 million solar program with British partner

Ukraine's largest private energy company DTEK and British clean energy group Octopus Energy have launched a program to install rooftop solar panels and battery storage systems at Ukrainian businesses and public institutions, DTEK said in a press release on June 23.The program, called RISE (Resilient Independent Solar Energy), was announced at Octopus Energy's Tech Summit in London and aims to raise 100 million euros ($115 million) to finance 100 energy projects over three years, helping stabiliz

Ukrainian energy giant to build $115 million solar program with British partner

Ukraine's largest private energy company DTEK and British clean energy group Octopus Energy have launched a program to install rooftop solar panels and battery storage systems at Ukrainian businesses and public institutions, DTEK said in a press release on June 23.

The program, called RISE (Resilient Independent Solar Energy), was announced at Octopus Energy's Tech Summit in London and aims to raise 100 million euros ($115 million) to finance 100 energy projects over three years, helping stabilize the grid, lower electricity costs and protect customers from outages, the company said.

DTEK’s facilities have been repeatedly targeted since the start of Russia’s full-scale invasion as Moscow sought to cripple Ukraine's energy infrastructure. The company was forced to shut down its gas production facilities in Poltava Oblast in March.

"About 70% of Ukraine's thermal generation capacity has been damaged, destroyed or seized since the full-scale invasion," said DTEK CEO Maksym Timchenko in the press release.

“This has created not only an urgent need to rebuild but also an opportunity to accelerate the shift to a decentralized, renewable energy system,” he added.

The alternative energy systems will be installed by D.Solutions, DTEK's business unit operating under the Yasno retail brand.

Installed equipment will run on Octopus Energy's AI-powered Kraken operating system, enabling businesses to optimize energy use in real time, reduce consumption during peak hours and sell surplus electricity back to the grid.

"They (DTEK) are rebuilding at pace and pioneering a decentralized, smart energy system powered by homegrown renewables," said Greg Jackson, Octopus Energy Group founder and CEO.

According to DTEK, Ukraine's commercial and industrial energy market has an untapped potential of 300 megawatts annually, valued at 200 million euros ($229 million). DTEK's Yasno brand serves over 60,000 business customers and can generate projects worth 30 million euros per year.

DTEK previously announced plans to build one of Europe's largest energy storage facilities with six installations across the country, totaling 200 megawatts to power 600,000 households. The company secured a $72 million loan from three Ukrainian banks.

The Kyiv IndependentKollen Post

The Kyiv IndependentKollen Post

-

The Kyiv Independent

-

Israel strike reportedly hits Iran’s gas sector, halting production at world’s largest field

Iran has partially suspended production at the South Pars gas field — the world’s largest — after an Israeli airstrike triggered a fire at the site, the semi-official Tasnim news agency reported on June 14, according to Reuters. If confirmed, it would mark the first Israeli strike targeting Iran’s vital oil and gas infrastructure.The South Pars field, located offshore in southern Bushehr province, is responsible for the bulk of Iran’s gas output. Tehran shares the field with Qatar, which refers

Israel strike reportedly hits Iran’s gas sector, halting production at world’s largest field

Iran has partially suspended production at the South Pars gas field — the world’s largest — after an Israeli airstrike triggered a fire at the site, the semi-official Tasnim news agency reported on June 14, according to Reuters. If confirmed, it would mark the first Israeli strike targeting Iran’s vital oil and gas infrastructure.

The South Pars field, located offshore in southern Bushehr province, is responsible for the bulk of Iran’s gas output. Tehran shares the field with Qatar, which refers to its portion as the North Field. A strike on South Pars represents a significant escalation, coming after oil prices surged 9% on June 13 following Israel’s initial wave of attacks, which had not targeted energy infrastructure, Reuters reports.

Israel launched its air offensive against Iran on June 13, killing commanders and scientists and bombing nuclear sites, in what it described as an effort to prevent Tehran from developing nuclear weapons.

The Iranian oil ministry said the fire caused by the strike has been extinguished. According to Tasnim, the fire broke out in one of four units of Phase 14 at South Pars, halting the production of 12 million cubic meters of gas.

Iran, the world’s third-largest gas producer after the United States and Russia, produces around 275 billion cubic meters of gas per year, about 6.5% of global output.

Due to international sanctions, the country consumes most of this domestically. Qatar, which operates the majority of the shared field with support from global firms such as Exxon and Shell, produces 77 million tonnes of liquefied natural gas annually, supplying both European and Asian markets.

The Kyiv IndependentChris York

The Kyiv IndependentChris York