Energy, not harvest: why Ukraine’s bread may soon cost a quarter more

Ukrainian bread prices may surge 25% in the coming months, but according to industry officials, the driver isn’t a wheat shortage—it’s Russia’s systematic attacks on energy infrastructure, pushing electricity, logistics, and production costs through the roof.

Russia’s energy warfare strategy has proven more effective at inflating food costs than destroying Ukraine’s agricultural capacity, revealing a sophisticated shift in economic warfare tactics.

Despite an 11% grain harvest drop this summer, Ukraine still produces three times more wheat than it consumes domestically, with 21.8 million tons harvested versus just 6-7 million needed for internal consumption, Denis Marchuk, deputy head of the Ukrainian Agri Council, told Ukrainian media.

When power costs more than wheat

The price disconnect reveals how Moscow’s strategy has evolved from targeting farms to incapacitating the entire food production chain through energy infrastructure strikes.

“Inflation in the food group is 22%. Electricity, logistics, and fuel costs for businesses are constantly rising, as is the need to raise wages,” Marchuk explained. “All these factors shape wholesale prices at bakeries much more than grain costs.”

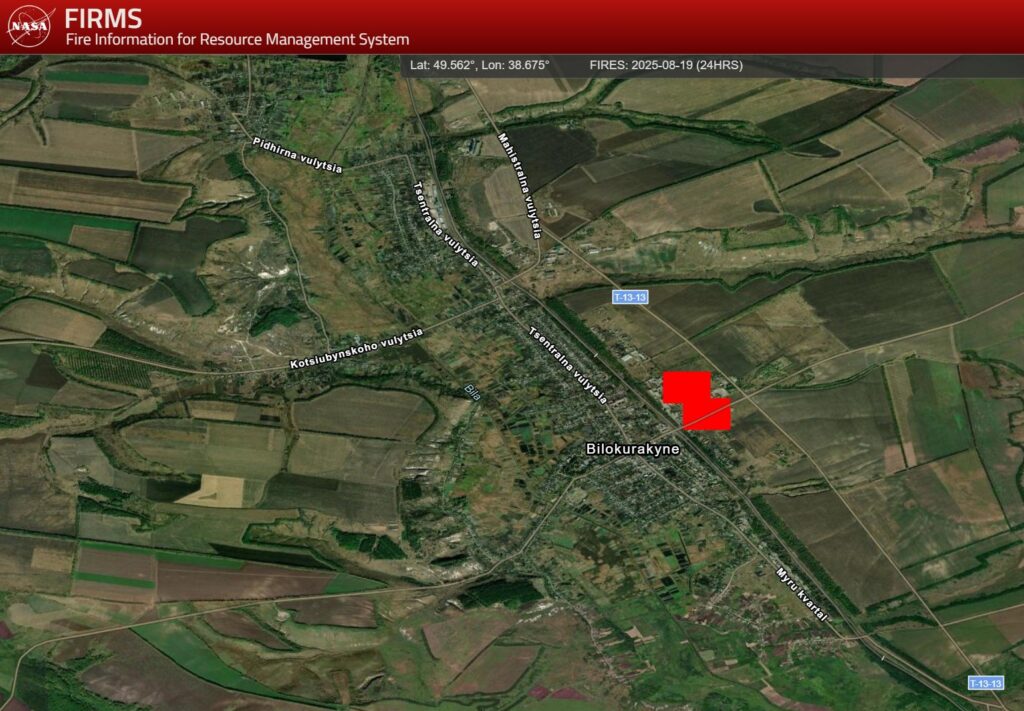

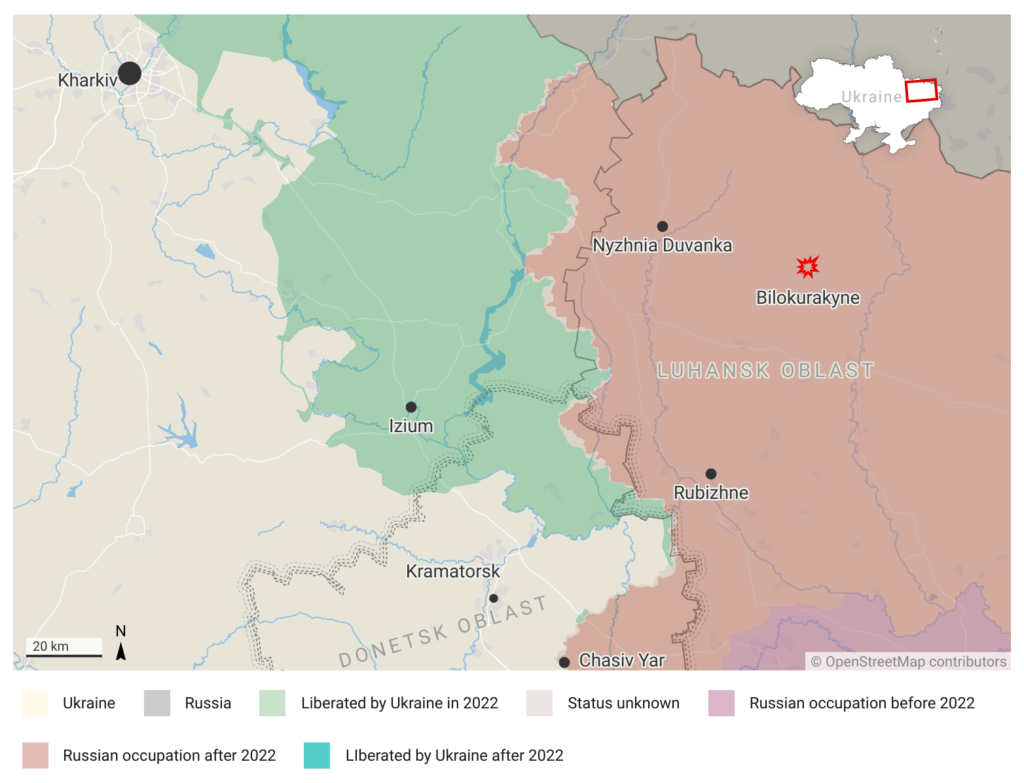

Russia’s escalating attacks reached new intensity just two nights ago when Moscow launched over 800 drones at Ukraine simultaneously, killing civilians in Kyiv.

This represents a massive escalation from February 2022, when the Energy Minister Herman Halushchenko reported Russia had conducted 30 mass strikes on energy infrastructure—attacks that now occur with unprecedented frequency and scale.

Industry pushes back on price projections

While the strategic shift is clear, the economic impact varies across Ukraine’s food industry. However, Marchuk’s 25% price hike projection should be taken with a grain of salt.

For now, it seems to represent the upper range of actual impacts, as industry representatives often emphasize worst-case scenarios when discussing regulatory or economic pressures.

Current bread prices remain elevated from previous years, but the full 25% increase would depend on sustained energy infrastructure damage and continued currency pressure affecting imported equipment costs.

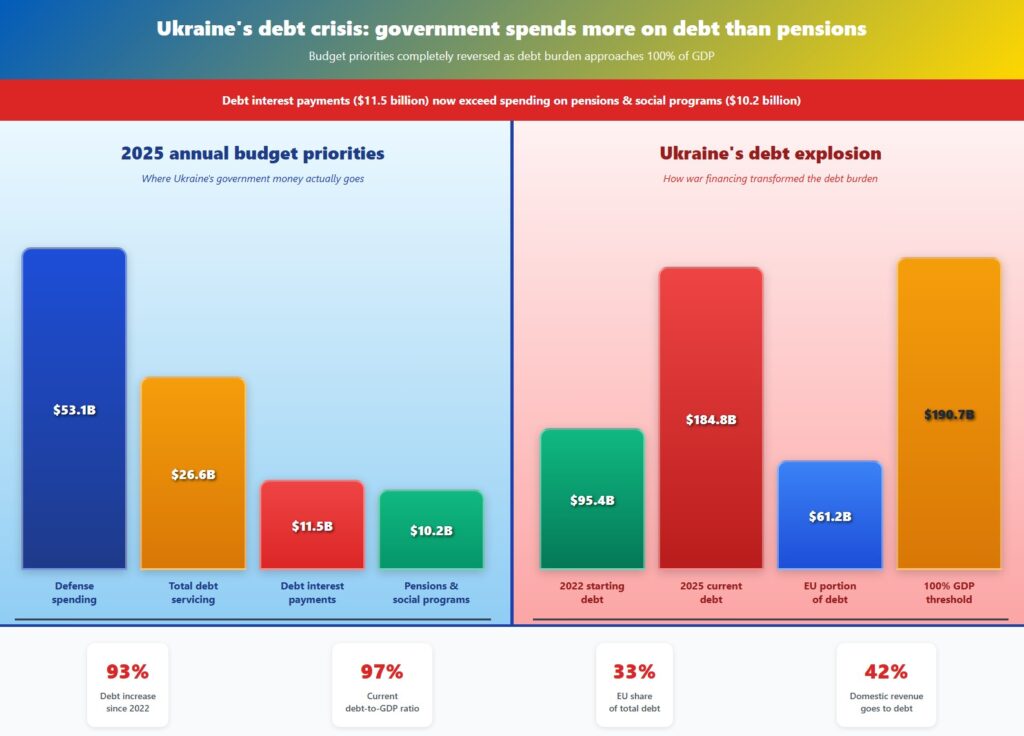

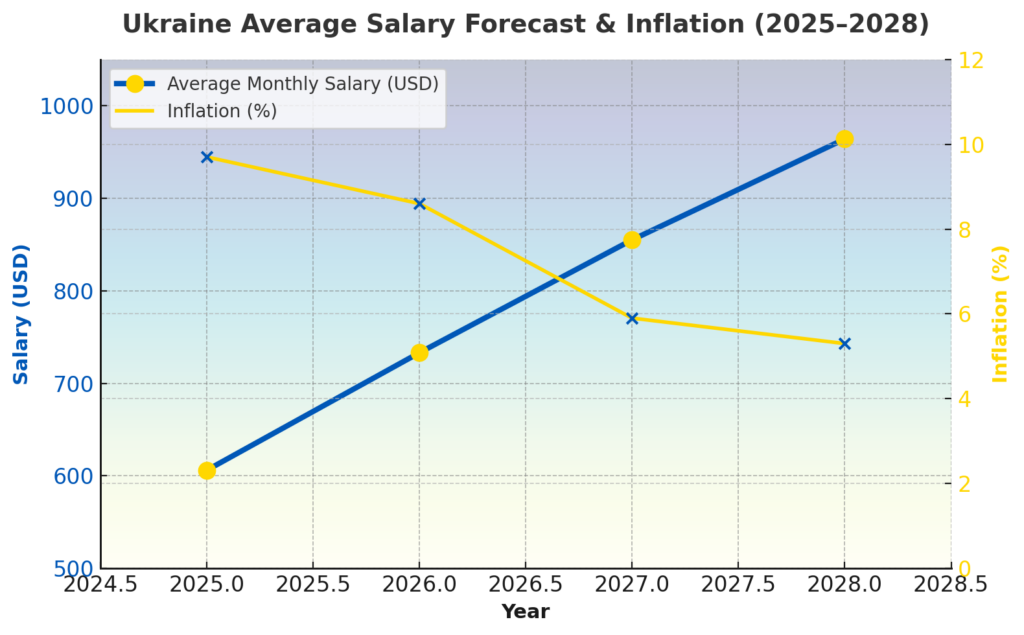

Ukraine’s National Bank raised interest rates to 14.5% in January to combat overall inflation, which reached 15.9% in May before moderating to 14.1% in July 2025.

Industry projections vary on the exact scale of increases, with some estimates more conservative than Marchuk’s 25% figure.

At the end of August, Yuriy Duchenko, director of KyivKhlib bakery, told AgroReview that bread prices may rise 15-20% by the end of 2025, citing increased costs for flour, energy resources, and wages as key drivers.

“In 2025, we see a trend toward product price increases… By the end of the year, I think there will be steps toward higher prices. It will be 15-20%,” Duchenko stated.

The KyivKhlib director noted that most bakery enterprises currently operate at the edge of profitability, with some forced to work at a loss—creating additional pressure on the industry and increasing the likelihood of further price increases.

Bread costs have already surged significantly, with prices rising 20% in 2024, according to Duchenko.

Current retail prices reflect this inflation: rye bread averaging 45.83 hryvnias ($1.11) for a 300-gram loaf in major Ukrainian supermarkets as of August 2025, while standard loaves (450 grams) now cost an average of 36.7 hryvnias ($0.89)—nearly 9 hryvnias ($0.22) higher than the previous year.

Agriculture survives, industry struggles

These price pressures highlight a crucial asymmetry in Russia’s economic warfare: while Ukraine’s agricultural sector has proven remarkably resilient, energy-dependent industries remain highly vulnerable to systematic infrastructure attacks.

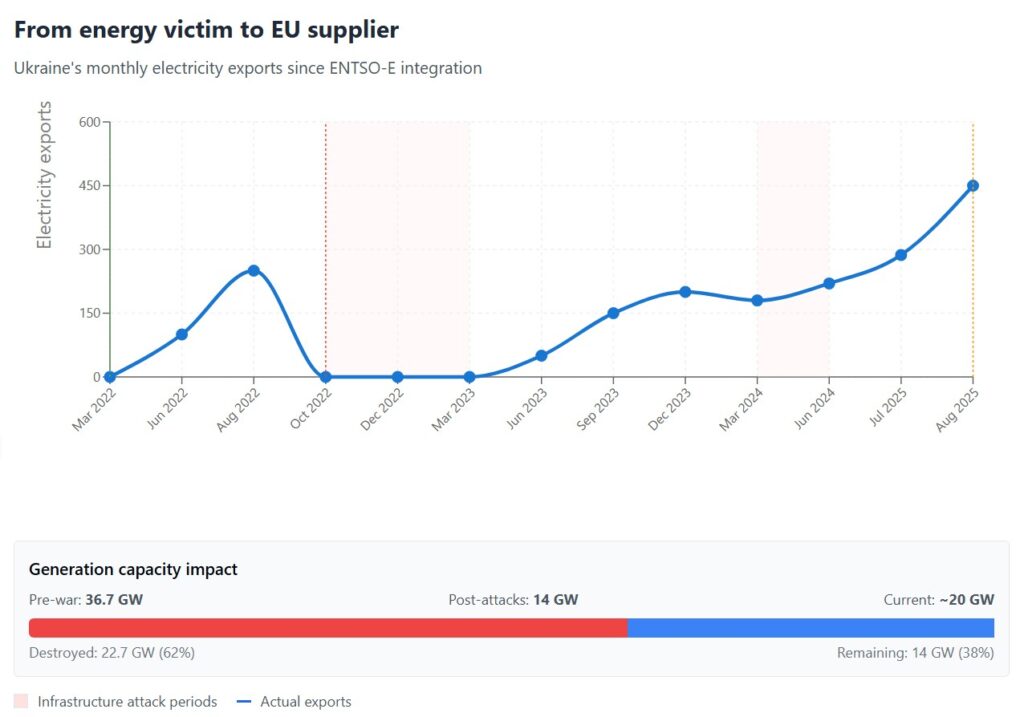

The country has lost 70% of its power generation capacity to Russian strikes, yet grain production remains sufficient for domestic needs.

This summer’s drought and damaged irrigation systems in southern oblasts reduced harvests, but northern and western regions compensated with strong yields—Lviv Oblast achieved 6.64 tons per hectare, well above national averages.

Russia’s systematic targeting of power plants, electrical substations, and energy infrastructure creates cascading cost increases throughout Ukraine’s economy.

When electricity becomes more expensive and unreliable, bakeries face higher operational costs, logistics companies pay more for fuel, and the entire food production chain becomes costlier—even when the grain remains affordable and abundant.

This is strategically more sophisticated than directly bombing food facilities.

By targeting the energy backbone, Russia can inflate costs across multiple sectors simultaneously while maintaining plausible deniability about “targeting civilian infrastructure.”

Read also

-

Russian drones target Ukraine’s energy sites to leave civilians without heat and light

-

Ukraine’s shrinking harvest threatens food security in developing nations

-

Russia strikes global food lifeline in Ukraine, killing two civilians and injuring many others

-

EU’s return to quotas on Ukraine food exports undermine path to single market, Ukrainian agriculture minister says