The slow squeeze: Russia’s oil empire is bleeding cash

Russia’s oil cash machine is breaking down. Rosneft just posted a catastrophic 68% profit collapse, with free cash flow plunging 75%. This is the clearest sign yet that Western sanctions combined with Ukrainian strikes are systematically dismantling the Kremlin’s war funding.

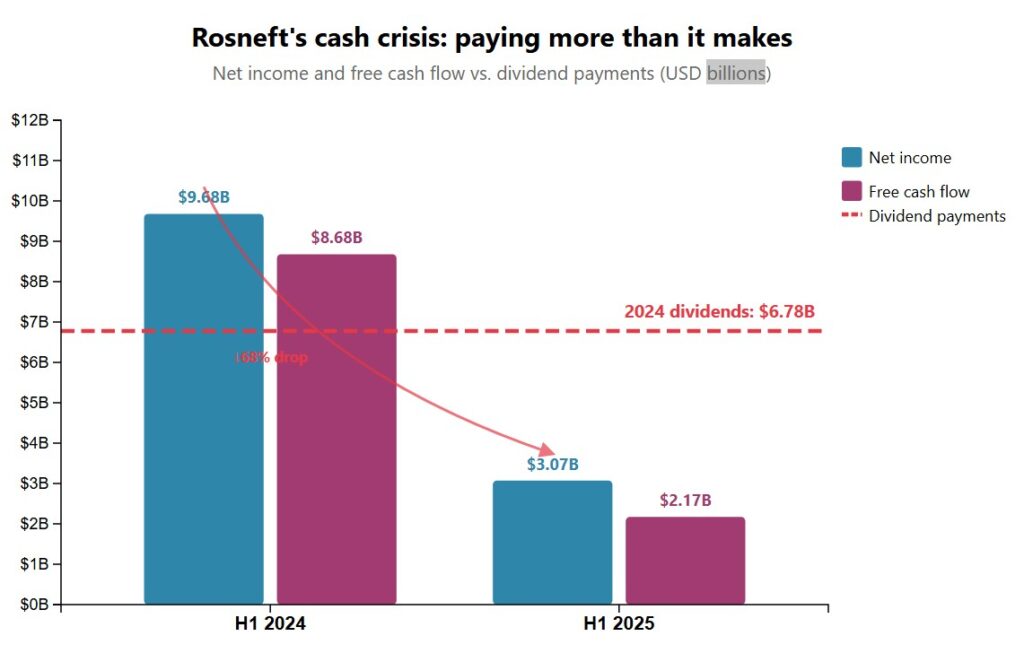

The numbers are brutal: net income crashed from 773 billion rubles ($9.68 billion) to just 245 billion ($3.07 billion) in the first half of 2025, while revenue fell 18% despite steady production.

Most telling?

Free cash flow collapsed to just 173 billion rubles ($2.17 billion)—a 75% drop that’s catastrophic for a company that paid out $6.78 billion in dividends and needs billions more for Arctic projects and war funding.

Ukraine’s drone war pays dividends

Rosneft CEO Igor Sechin’s complaints tell the whole story. He blamed “tighter EU and US sanction restrictions” for forcing steeper discounts on Russian crude, while a stronger ruble crushed export earnings.

Translation: the Western financial squeeze is working exactly as designed.

Even more revealing, Sechin is now publicly griping about the OPEC+ strategy (the cartel of 22 major oil producers, including Russia and Saudi Arabia, that coordinates global production), showing Russia can no longer influence global oil policy from a position of strength.

The man once skeptical of OPEC cooperation is now begging the cartel to prop up prices.

Meanwhile, Ukrainian drone strikes are systematically crippling Russian refining capacity. Depending on sources, up to 17% of Russia’s refining capacity is offline, with some regions introducing fuel rationing and wholesale gasoline prices up 45% despite falling global crude prices.

The strategic validation

For Western policymakers, Rosneft’s collapse validates the slow-squeeze approach.

Russia maintains production but struggles with profitability—exactly what sanctions architects intended.

The company still managed to raise capital spending 10% to 769 billion rubles ($9.63 billion), focusing on remote Arctic projects like Vostok Oil that won’t deliver volumes for years. But it’s paying 2024 dividends of 542 billion rubles ($6.78 billion)—more than triple this year’s actual cash generation.

That math doesn’t work long-term.

Watch these numbers

Two metrics matter most: Russian crude discounts to Brent prices and USD/RUB exchange rates. Small moves in either can swing Russia’s oil revenues by billions.

Rosneft now budgets conservatively at $45/barrel oil—signaling Moscow expects prices and sanctions pressure to persist. Combined with Ukrainian infrastructure strikes and Western financial restrictions, Russia’s oil empire faces its toughest test since the Soviet collapse.

The takeaway for global energy markets: economic warfare is working—slowly and systematically.