Ukraine’s An-124 Ruslan successfully relocated to Germany after modernization

At least three of Russia’s largest banks are reportedly exploring bailouts from the Kremlin, Bloomberg News revealed in a report cited by The Telegraph. Borrowers across the country are increasingly unable to repay loans, exposing rising financial fragility in the war-weary economy.

The request for state support marks a new phase in Russia’s economic troubles, where years of war-related spending, sanctions, and labour shortages are colliding with falling revenues and rising inflation.

Officials have instructed banks to restructure their books to disguise the scale of bad loans, but that tactic is running out of road. As The Telegraph reports, the government may soon need to intervene more directly to stabilize the sector.

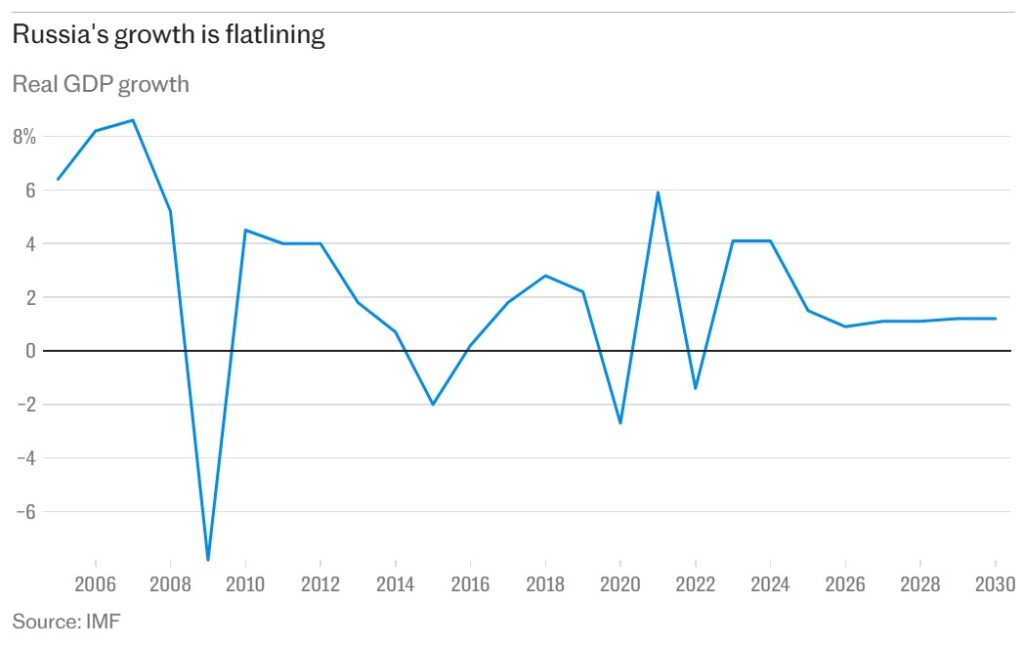

Though Russia’s economy officially grew 4.3% in 2024, much of that expansion was driven by military spending—one in every three roubles spent by Moscow now goes to the armed forces.

Behind the headline growth, key indicators point to a downturn. Business activity has dropped to its lowest level since the 2022 invasion began, and Goldman Sachs forecasts just 0.5% GDP growth in 2025. The private sector is weakening, labour shortages persist, and inflation has entered double-digit territory, driven by soaring food prices. Even potatoes are now in short supply, The Telegraph notes.

Russia’s critical oil revenues have plunged by a third compared to last year, with prices falling from $85 to $67 a barrel and access to international markets limited. The Bank of Russia’s 20% interest rate has failed to tame inflation, while high state payments to soldiers are further straining public finances.

Goldman Sachs also expects the rouble to depreciate by up to 30% against the US dollar this year, which would raise import costs and drive inflation higher still.

President Donald Trump has threatened to impose 100% tariffs on US imports from countries trading with Russia unless President Vladimir Putin agrees to a deal on Ukraine. If enacted, this could further isolate Russia’s economy from global trade networks.

As The Telegraph puts it, “The banks are quietly bracing for the worst.” With key sectors under strain and financial institutions now seeking state support, Russia’s economic resilience may be wearing thin. However, it remains unclear whether these challenges pose a critical threat to the Kremlin’s ability to sustain its war in Ukraine.

Russia’s war has triggered a tsunami of crises, says Bob Rae, President of the UN Economic and Social Council (ECOSOC) and Canada’s Permanent Representative to the UN. Moscow’s aggression against Ukraine has sparked a global food crisis, mass displacement, and setbacks in achieving the Sustainable Development Goals, UkrInform reports.

Russia shows no signs of being ready to end its war on Ukraine. On the contrary, Moscow is intensifying attacks on civilians and accelerating the arms race with the help of its partners, Iran, China, and North Korea. The logic of power based on nuclear deterrence has effectively been eroded by the development of drones. International law, too, was broken after the annexation of Crimea.

Rae notes that the war has sharply increased food prices for billions of people, endangered food security, and caused large-scale forced migration both within Ukraine and beyond its borders. This poses a serious challenge to the international community, which must ensure that people’s basic needs, especially access to affordable food, are met.

According to Rae, Russia’s effect on the global economy has been consistently negative. Even though inflation is beginning to ease, its effects remain deeply felt in many countries.

The diplomat likens the war’s impact not to “ripples on the water” but to a tsunami, so vast is the scale of the invasion’s consequences on a global level.

At the same time, he emphasizes that despite all challenges, Ukraine remains strong: its economy is holding, and its people continue to resist. Rae expresses hope that international support would remain as resilient as Ukraine itself.

You could close this page. Or you could join our community and help us produce more materials like this.

We keep our reporting open and accessible to everyone because we believe in the power of free information. This is why our small, cost-effective team depends on the support of readers like you to bring deliver timely news, quality analysis, and on-the-ground reports about Russia's war against Ukraine and Ukraine's struggle to build a democratic society.

Become a patron or see other ways to support.

© Alyssa Schukar for The New York Times

© Haiyun Jiang/The New York Times

© Haiyun Jiang/The New York Times

Kyiv has secured record-breaking aid at the latest international summit in Italy. During the fourth and largest Recovery Conference in Rome, Ukraine signed nearly 200 agreements and memorandums totaling €11 billion in support, says First Deputy Prime Minister and Minister of Economy Yuliia Svyrydenko.

“The Ukraine Recovery Conference 2025 in Rome was the most extensive yet, both in terms of participants and the quality of agreements. Over 6,000 participants from 70 countries, around 200 agreements signed, worth approximately €11 billion,” Svyrydenko states.

One key outcome was the launch of the largest European investment fund for Ukraine’s reconstruction, with four countries and major European development banks pledging support.

Under the Ukraine Investment Framework, a new aid package worth over €2 billion was announced. The Netherlands committed an additional €500 million over 10 years, while Switzerland pledged close to €5 billion in assistance.

Defense industry cooperation was also a central focus of the summit, with discussions on localizing production, creating joint ventures, and sharing technologies.

Among the major industrial initiatives:

Ukraine also focused on new employment programs for women, initiatives to support female entrepreneurship, and commitments to modernize labor legislation.

The conference took place amid an escalation of Russian attacks on Ukraine. Recently, Moscow began launching over 700 drones in a single night, targeting Ukrainian cities. Therefore, the focus of the conference extended beyond reconstruction and included defense.

© Scott McIntyre for The New York Times

© Haiyun Jiang/The New York Times

The European Commission is discussing with EU member states various options to cover Ukraine's budget deficit for next year, which could range from $8 billion to $19 billion, the Financial Times reported on July 8.

International partners have provided Ukraine with over $39 billion for its wartime economy so far this year, Prime Minister Denys Shmyhal announced.

The financial hole in Ukraine's budget is linked to reduced U.S. support and the lack of prospects for a swift ceasefire with Russia that Europe had hoped for, the Financial Times reported.

A senior EU official told the publication that many of Ukraine's partners had previously counted on a peace deal in 2025, but are now forced to revise their funding plans.

This includes the European Commission, which has already adjusted spending from Ukraine-related funding streams.

Without support from Western partners, Kyiv would face a budget deficit of $19 billion in 2026, according to the Financial Times. However, even if additional international financing for the wartime economy can be secured, a gap of at least $8 billion would remain.

To support Ukraine's budget, Europe is considering providing military aid in the form of off-budget grants that would be recorded separately as external transfers but would count toward NATO member countries' national defense spending targets.

One EU diplomat told the Financial Times that military support for Ukraine is viewed as a contribution to the defense of all of Europe.

In a document for G7 countries reviewed by Financial Times, Kyiv proposed that European allies co-finance Ukrainian forces, framing this as a service to strengthen continental security.

Other support options under discussion include potentially accelerating payments from the existing $50 billion G7 loan program and reinvesting frozen Russian assets in higher-yield financial instruments that the EU allocated to help service the debt.

According to the Financial Times, two sources confirmed that the commission planned to discuss these options with EU finance ministers on July 8.

The funding issue will also be raised at the Ukraine Recovery Conference in Rome on July 10-11, dedicated to Ukraine's reconstruction needs. European Commission President Ursula von der Leyen will attend the event.

The European Commission is urgently discussing with EU and G7 countries how to prevent a major financial shortfall in Ukraine in 2025, the Financial Times reports. The projected gap in external funding could reach $19 billion, amid declining US support and no immediate prospects for a peace deal with Russia.

US President Donald Trump has agreed to resume arms deliveries to Ukraine, but at a reduced scale. According to sources, he pledged to send just ten Patriot interceptor missiles immediately instead of the full shipment that had previously been suspended. Meanwhile, AIM-120 and Hellfire missiles, GMLRS munitions, howitzer rounds, Stingers, and grenade launchers are stuck.

Among the solutions under consideration:

The European Commission admits that some Ukrainian support spending has already been adjusted, given the prolonged nature of the war. Diplomats emphasize that funding Ukraine’s defense should be seen as part of the EU’s own security investment.

“Clearly the military support for Ukraine that member states are giving are not only funds for the defense of Ukraine but for the defense of Europe, and some of that of course will count as defense spending,” says one senior EU diplomat.

One proposal submitted by Ukraine to the G7 suggests that bilateral defense grants could count toward NATO defense spending commitments. This would allow allies to simultaneously support Ukraine and move closer to meeting the 2% or even 5% GDP targets.

Despite more optimistic assessments from the IMF, the fund acknowledges that the deficit could grow if the war continues beyond 2025. In 2026 alone, Ukraine may require at least another $8 billion, even considering deferred tranches from the EU, US, and Japan.

The urgency is intensifying ahead of the Ukraine Recovery Summit in Rome this week, where Ursula von der Leyen will participate. Meanwhile, the European Commission is preparing to unveil new financial initiatives to support Kyiv before winter sets in.

Russian weapons supply failure confirmed by courts is at the center of an investigation by The Insider, which analyzed arbitration rulings involving nine defense contractors. The findings reveal that sanctions are not just symbolic—they are dismantling the Kremlin’s war machine from within.

Sanctioned by the G7 and EU over its full-scale war on Ukraine, Russia evades restrictions via third countries while pushing propaganda that they hurt the West more. Meanwhile, the EU’s newest sanctions package remains blocked by pro-Russian Hungary, and US President Trump, though hinting at new US measures, has yet to act—still banking on unrealistic peace negotiations.

In case after case, Russian manufacturers admitted they could not fulfill military contracts due to the unavailability of sanctioned components. A shipment of programmable chips from Azimut LLC to NTC Elins was rejected after the Chinese replacements failed to function with the Ministry of Defense’s software. In court, Elins declared the chips unusable, citing their incompatibility.

Zaslon JSC, tied to United Russia’s Andrei Turchak, claimed a batch of microchips delivered under contract showed signs of tampering. The company’s technical experts pointed to “numerous scratches” consistent with reballing – tampering the microchips for the reuse. The court agreed and dismissed the supplier’s claim.

One lawsuit revealed that Northern Star LLC imported banned electronics via ARP Investment, a firm registered in the British Virgin Islands. The operation routed shipments from Chinese firms under European branding. The court documents directly confirmed that Northern Star was supplying these goods for Russia’s Ministry of Defense.

The choice of the BVI—a British Overseas Territory—made the scheme unusually risky. UK authorities have access to its corporate registry, which means the real beneficiaries of such supply chains can be easily identified.

NaukaSoft was tasked with delivering a power supply for SES-7000-NS drones. The supplier couldn’t manufacture key connectors—once a Soviet strength—leading to court-ordered penalties. Without access to lighter imported equivalents, the company failed to meet even basic technical specifications.

The Amur Shipbuilding Plant sued the Priboy Plant after it failed to deliver the Zarya-2 sonar system. The system, essential to the corvettes Grozny and Bravy, relied on components banned under EU sanctions. Priboy admitted its suppliers could not fulfill the order, and its efforts to use “domestic” replacements failed when the Russian-made parts were found to contain foreign chips themselves.

One legal dispute showed how a British manufacturer canceled delivery of specialized maritime communication modules after detecting at least ten conflicting orders—all designed to hide the Russian military end user.

“Since the end user of the product was the plaintiff,” the ruling states, the supplier “was unable to provide the documentation requested by the manufacturer.”

The module was for NII Elektropribor, which builds navigation and gyroscopy systems for military vessels.

Technolink LLC’s attempts to import lab equipment were thwarted when banks in Kyrgyzstan and Türkiye closed accounts linked to suspect shipments. Courts revealed how one of the supplier’s Kyrgyz partners had its account shut down even before a contract was signed. In Türkiye, DenizBank closed accounts entirely.

Uzbek banks rejected payments based on customs commodity codes, while Kyrgyz authorities demanded import licenses. The courts ruled that these shutdowns were predictable under current sanctions conditions and rejected claims of force majeure.

In another case, Russian Space Systems was left without frequency generators after Swiss company AnaPico AG halted deliveries. AnaPico’s Russian partner admitted in court it could no longer fulfill contracts after Swiss authorities intervened. Russian courts terminated the contract.

The Russian National Guard refused to accept an anti-drone system after the Ford Transit chassis was replaced with a GAZelle, citing contract violations. The supplier blamed foreign automakers’ exit from Russia. The court ruled that the supplier had no alternative and upheld the replacement.

Across every case, Russian arbitration courts exposed a common thread: the country’s military industry cannot operate without sanctioned foreign tech. None of the failures involved personal sanctions—only export controls on dual-use, non-consumer goods.

The Insider’s investigation concludes that Russia’s efforts to smuggle, substitute, or manufacture its way around sanctions fail. The courts have documented the consequences: stalled ships, grounded drones, rejected deliveries, and a defense sector in crisis.

“The conclusion is clearly supported by Russian court rulings: sanctions are having a material impact on the work of Russia’s military-industrial complex,” The Insider’s investigation wrote.

© Michael A. McCoy for The New York Times

© Michael A. McCoy for The New York Times

Trump can make Russia pay — not by deploying troops, but by taking action with what’s already in US hands. As detailed in a Forbes op-ed by Andy J. Semotiuk, after President Trump’s recent phone call with Vladimir Putin, the Kremlin rejected any peace and resumed bombing Ukraine.

Reports indicated that Russia launched nearly 5,500 missiles and rockets in June 2025 alone. Up to 1,000 drone strikes per day could hit Ukraine in August.

Even as the West backs Ukraine militarily, it continues buying Russian oil and gas — channeling far more money into Putin’s war machine than it sends to Ukraine, Forbes says. Since February 2022, Western energy payments have tripled the aid given to Kyiv. Russia, meanwhile, has inflicted over $552 billion in theft and destruction — looting grain, steel, industrial equipment, and flattening critical infrastructure.

According to Forbes, Russia has inflicted more than $552 billion in theft and destruction across Ukraine — seizing over 1,150 companies, looting grain and steel, and devastating infrastructure. These losses underscore the scale of Moscow’s economic war alongside its military one.

Semotiuk notes that $330 billion in frozen Russian sovereign funds are sitting untouched in Western banks. Trump can make Russia pay by leading a legal effort to seize those funds — a move with precedent, as the US has done with Iraq and Afghanistan. That money alone could cover Ukraine’s defense and reconstruction for three years. Acting swiftly would likely push allies like Canada, the UK, and EU states to follow.

Historian Timothy Ash, quoted in the op-ed, estimates Ukraine needs $150 billion annually to secure victory. If it loses, NATO could face over $4.5 trillion in defense spending within a decade. Mass refugee waves, destabilized markets, and aggressive moves by China or North Korea would likely follow. Funding Ukraine now prevents far greater costs later — both financial and strategic.

Semotiuk argues that supporting Ukraine also means cutting off Russia’s revenue stream. The US and its allies — especially Canada — have the capacity to replace Russian energy in global markets. That would boost Western economies and deny Putin the cash to wage war. Countries still purchasing Russian oil — including China, India, Türkiye, Brazil, and several EU members — should face strict US sanctions.

For over 30 years, Ukraine has supported every major US military operation. In return, Washington pledged protection in the 1994 Budapest Memorandum, when Ukraine gave up its nuclear arsenal. Turning away now, Semotiuk warns, would shatter US credibility.

The op-ed notes that Ukraine has already inflicted immense damage on Russia’s military: over a million troops dead or wounded, the Black Sea Fleet decimated, and weapons facilities under constant attack. All without a single American soldier on the battlefield.