Canada’s pension cash is moving Putin’s $ 4 billion gas cargoes—end it now

In 2024 alone, the LNG tanker fleet of the Glasgow-registered Seapeak Maritime lifted 7.56 million tonnes of liquefied natural gas from Russia’s Yamal Peninsula—more than a third of all cargoes the giant Arctic plant exported last year.

At prevailing gas market prices, those shipments were worth roughly £2.9 billion ($3.7 billion), generating an estimated £127 million ($163 million) in corporate income tax for the Russian state.

This is enough to buy 2,700 Shahed drones or 45 Iskander missiles for use against Ukrainian cities.

A closer look at Seapeak shows a multinational war profiteering scheme with the involvement of seemingly incompatible partners: Canada, the UK, the US, and China. The governments of the first two constituencies have the killswitch in their hands, and they can close down the scheme if they want to walk the talks on supporting Ukraine and confront the Russo-Chinese dirty energy sprawl in the Arctic.

A loophole big enough for an icebreaker

Seapeak’s seven Arc-7 ice-class carriers, managed from an ordinary office block in Glasgow, Scotland, shuttle Russian LNG from the port of Sabetta through the Barents and Norwegian Seas to EU terminals such as Zeebrugge, Bilbao, and Montoir. Their cargoes are then off-sold under long-term contracts to buyers including France’s Total Energies, Germany’s SEFE, and Spain’s Naturgy, quietly feeding European gas grids even as Brussels vows to wean itself off Kremlin energy and London claims to be “clean on gas”.

The Russian LNG trade lays bare a giant blind spot in Western sanctions.

The UK banned direct imports of Russian LNG from 1 January 2023, yet it still allows British-managed or British-insured vessels to haul Putin’s gas for third parties and continues to buy gas from TotalEnergies, Novatek’s key partner in the LNG export business. Worse, Seapeak’s ships have been linked to the presence of Russian FSB special service operatives on board—an obvious counter-intelligence threat for NATO states whose ports they frequent.

The six Arc-7 icebreaking LNG carriers managed by Seapeak Maritime – Eduard Toll, Rudolf Samoylovich, Vladimir Voronin, Nikolay Urvantsev, Georgiy Ushakov, and Yakov Gakkel – operate year-round and export millions of tons of Russian gas from the Sabbeta port at the Yamal peninsula.

Based on average prices for Russian LNG during 2024, the estimated value of the LNG deliveries carried by these vessels in 2024 was around £2.9bn (€3.44bn / $3.72bn), which represents a significant portion of the Yamal LNG total revenue. The LNG volumes carried by the Seapeak fleet directly generated revenue for the Yamal LNG plant, which is located in and operates in Russia, and is subject to taxation under the Russian tax code.

What is Seapeak — and who owns it?

Until early 2022, the company traded LNG at global markets as Teekay LNG Partners, part of the Canadian-founded Teekay Group headquartered in Vancouver. That January, New York private-equity house Stonepeak Infrastructure Partners bought it for US $6.2 billion and re-branded it Seapeak LLC. The Glasgow subsidiary, Seapeak Maritime Ltd, manages the Yamal LNG fleet and books revenue in Britain’s financial system.

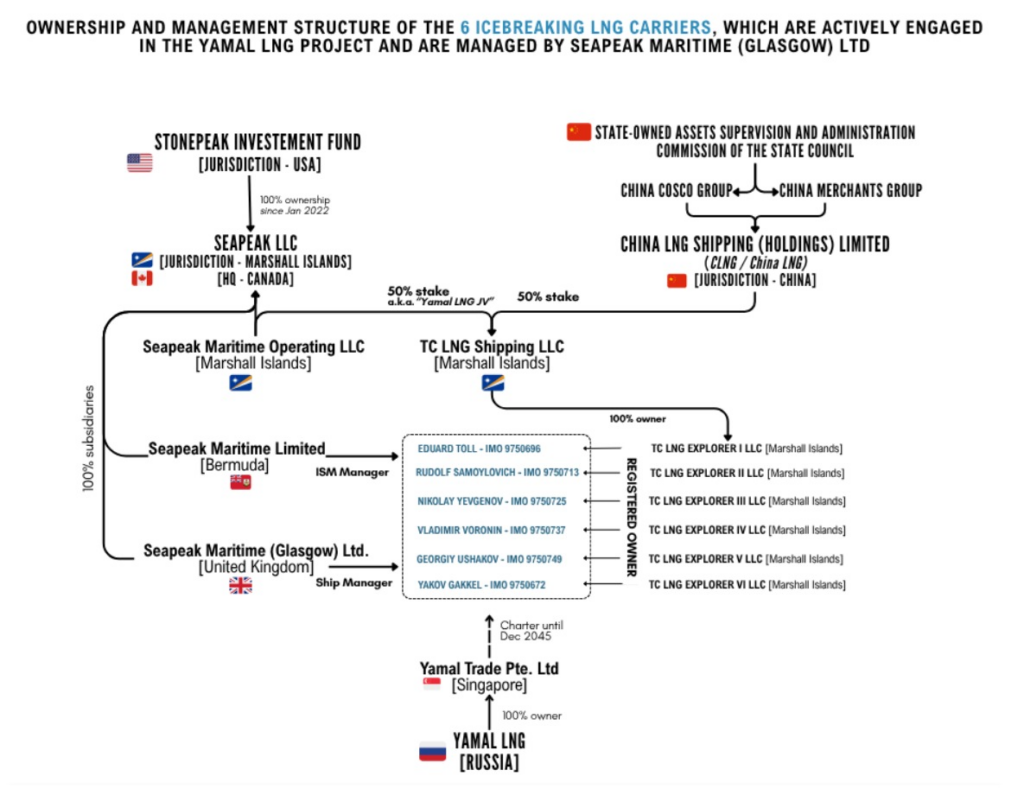

When we look into the ownership of the Arc7 tanker fleet, the vessels themselves, things get even more complicated. Seapeak LLC co‑owns the six Arc‑7 LNG carriers in a joint venture with China LNG Shipping Holdings Limited – TC LNG Shipping LLC, which is a Marshall Islands entity established in April 2014. China LNG Shipping Holdings Limited is a major Chinese LNG shipping company incorporated by a consortium of COSCO Shipping Energy Transportation Co., Ltd. and China Merchants Energy Shipping Co. Ltd., which collectively belong to China’s State-owned Assets Supervision and Administration Commission of the State Council.

In other words, Canadian investors and China’s communist party teamed up to build the LNG fleet driving Russia’s global gas expansion.

Then, in early 2022, US-based investment firm Stonepeak took over the business.

Stonepeak’s investors include North American pension funds and Canadian public-sector institutions; the parent company itself remains registered in Bermuda offshore. This opaque structure means profits extracted from Yamal transit flow through a thicket of tax havens before re-emerging as dividends for western investors, all while Ukraine picks through the increasingly dense, deadly showers of missile and drone attacks made possible by Russian tax receipts.

National security, not business as usual

If the United Kingdom is serious about enforcing its sanctions regime, leaving Seapeak to continue uninterrupted business with Russians and Chinese is no longer tenable. Westminster already has precedent: it has sanctioned entire fleets of Russian-controlled oil tankers and pledged to lead the fight to dismantle Moscow’s “shadow fleet”. Extending that approach to vessels that facilitate Russian LNG exports is a logical next step — yet action against the management entity itself would be swifter and more comprehensive.

Nationalising Seapeak’s tankers under UK emergency powers would freeze Kremlin revenues and let authorities redeploy, idle, or sell the Arc-7 LNG fleet in line with allied priorities.

Canada, too, has skin in the game. Teekay’s historical ties to Vancouver mean Ottawa retains leverage via the Special Economic Measures Act. By taking control of Seapeak’s Canadian holdings, Canada can ensure its pension funds are not, however indirectly, bankrolling Russian aggression. A joint UK-Canadian move would also close the insurance loophole: once the ships are state-controlled, renewals with London P&I clubs could be halted overnight.

The Kremlin’s Trojan horse

Corporate ownership is only part of the story. Glasgow is today home to a vibrant Ukrainian diasporic community; yet the city’s largest shipping firm remains an unwitting enabler of the Kremlin’s Arctic ambitions. The profits Seapeak generates upstream help Russia’s gas giant Novatek—half-owned by Putin loyalist Leonid Mikhelson—expand LNG mega-projects whose carbon footprint outstrips several EU member states combined. Downstream, those same profits support Russia’s vast propaganda ecosystem and its espionage networks inside Europe’s ports.

Journalist investigations showed that Novatek has been directly implicated in supporting Russia’s military actions in Ukraine by recruiting mercenaries through its private security company, Saturn-1.

Staff from Novatek’s security divisions, including Bastion, were sent to the front lines and paid via the Muzhestvo Foundation—a fund largely financed by Novatek.

Therefore, Russia’s leading LNG exporter’s role in the war of aggression extends beyond finance to direct participation on the battlefield.

A call to act—now

Pulling the killswitch—nationalizing Seapeak’s Arc7 vessels (which has precedent with Germany’s action in 2022 against Gazprom Germany)—would not be a hostile act against free enterprise; it would be a wartime necessity on a par with the seizure of oligarch superyachts and cutting schemes that fund war crimes. It would deprive Russia of hundreds of millions in tax revenue, shut down a strategic export route through the Arctic’s melting ice, prevent further Russo-Chinese expansion in the Arctic, and send an unmistakable signal that allied democracies will choke off every last revenue vein feeding Putin’s war machine.

The alternative—allowing a Canadian-heritage company owned by Wall Street financiers to keep moving Arctic gas for the benefit of Russian warmongers and Chinese crooks, while Ukrainian civilians count the cost—should shame every lawmaker in Westminster and Ottawa.

Britain and Canada helped design today’s sanctions architecture; they must now wield it without fear or favour.

Each cargo Seapeak lifts from Sabetta is another cheque signed over to the Kremlin. The governments of the UK and Canada must investigate Stonepeak’s entanglements with Russia and China. While the EU is taking the course to wean itself from dependency on Russian LNG, it’s about time to nationalise the fleet that is carrying it. This could prove that when Ukraine asks its friends and allies to close a loophole measured in megatonnes of Russian gas and billions of dollars, they will answer with deeds, not declarations.

Oleh Savytskyi

Editor’s note. The opinions expressed in our Opinion section belong to their authors. Euromaidan Press’ editorial team may or may not share them.

Submit an opinion to Euromaidan Press