Denmark to Buy Long-Range Weapons in ‘Paradigm Shift’

© Emil Nicolai Helms, via Getty Images

© Emil Nicolai Helms, via Getty Images

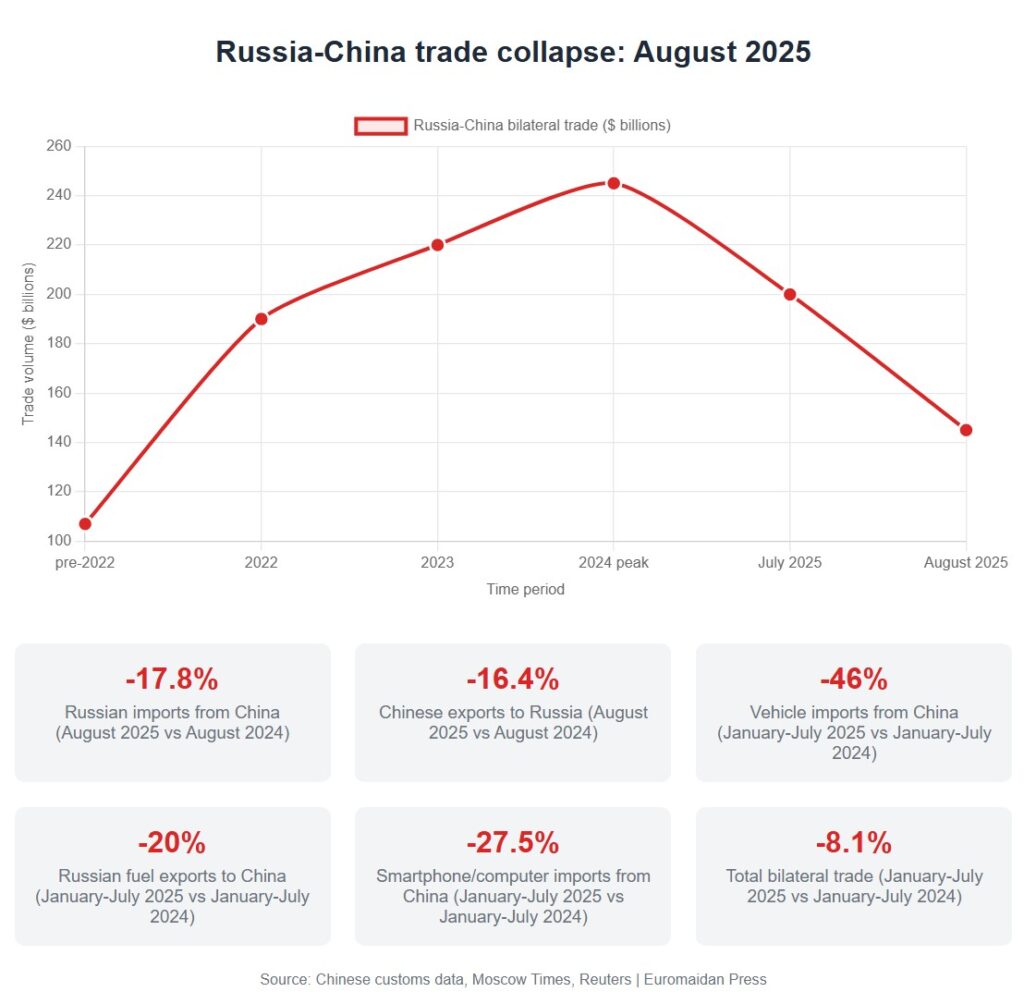

Russian imports from China plummeted 17.8% in August compared to last year, Chinese customs data shows, marking the steepest monthly decline since Moscow began relying on Beijing as its economic lifeline after invading Ukraine.

The collapse in trade that once sustained Putin’s war economy has prompted frustrated Russian officials to tell Reuters that China “does not behave like an ally” and sometimes engages in “outright robbery.”

Chinese imports from Russia dropped 17.8% year-over-year in August, while Chinese exports to Russia fell 16.4% — double July’s decline rate of 8.6%, according to Chinese customs data reported by The Moscow Times.

The cumulative damage over eight months has reduced bilateral trade by almost 9% to $145 billion, ending three years of explosive growth that began when Western sanctions forced Russia to seek alternative markets after its February 2022 invasion of Ukraine.

This decline came despite Putin’s September visit to China, where he signed what he claimed was a breakthrough memorandum on the Power of Siberia 2 gas pipeline — only to see Gazprom shares tumble 3.1% as investors recognized it as another non-binding agreement.

The trade decline reflects multiple pressures on the relationship. Russian Industry Minister Anton Alikhanov blamed sanctions and volatility in commodity markets for falling bilateral trade at a business forum in Kazan.

He also noted that Russia is seeing a gradual saturation of Chinese products in certain market segments.

The pressure intensified after then-Secretary of State Antony Blinken warned China during the Biden administration about sanctions evasion, which led to Chinese exports to Russia declining 16% in March 2024.

Chinese financial institutions have reportedly ceased processing yuan-denominated transactions from Russia, forcing Moscow to rely increasingly on alternative payment methods.

The August data reveal the breadth of the trade collapse. Russia’s fuel exports to China fell almost 20% from January to July, while vehicle imports from China — including passenger cars, tractors, and trucks — plummeted 46% to $5.8 billion.

Smartphone and computer imports dropped 27.5% over the same period, reflecting market saturation and sanctions complications.

The vehicle sector illustrates the problem of Chinese market dominance. Chinese carmakers surged from less than 10% of Russia’s auto market before the war to commanding more than half by mid-2023, creating dependency that Russian officials now regret.

The revenue shortfall comes as Russia faces mounting costs from its prolonged war in Ukraine. The partnership had been crucial for Putin’s narrative that Russia could successfully replace Western markets with alternative relationships.

Chinese companies continue supplying components for Russian weapons production, but Beijing maintains a careful distance from direct military support while extracting maximum economic benefit from Russia’s isolation.

The trade decline suggests for Ukraine and its allies that sanctions pressure, combined with Chinese caution about secondary sanctions, is successfully constraining Russia’s ability to finance its war machine through alternative partnerships.

The deteriorating relationship also exposes the fundamental weakness in Putin’s strategy of building alternative alliances, revealing instead a relationship in which Russia has become a junior partner dependent on Beijing’s goodwill.

New Delhi is taking a step in defiance of American demands. Bloomberg reports that India has officially confirmed that it will continue buying Russian oil despite the 50% US tariffs on Indian goods.

India has condemned the US decision, pointing out double standards: Europe itself continues to purchase oil from Russia. EU–Russia trade in 2024 reached €67.5 billion in goods and €17.2 billion in services. Europe also imported a record 16.5 million tons of Russian LNG, the highest number since 2022.

“Where we buy our oil from, especially a big-ticket foreign exchange item where we pay so much, the highest in terms of import, we will have to take a call on what suits us best. We will undoubtedly be buying,” stated India’s Finance Minister Nirmala Sitharaman.

In doing so, New Delhi ignored US President Donald Trump’s demand to stop importing Russian oil, prompting renewed public criticism from him.

“Looks like we’ve lost India and Russia to deepest, darkest, China. May they have a long and prosperous future together!” Trump wrote in a social media post, adding a photo of the three leaders together at Xi Jinping’s summit in China.

Meanwhile, Andrii Kovalenko, head of Ukraine’s Center for Countering Disinformation, has reported that Russian oil shipments to India fell from 1.8 million barrels per day in 2024 to 1.1 million in September 2025.

“Delhi is demanding additional discounts and payments in non-convertible rupees. US tariffs on Indian goods for Russian oil have already reached 50%,” he says.

He adds that the US and EU sanctions have limited Moscow’s oil trade, and now India and China are dictating the terms.

At the same time, Kovalenko reveals that China has increased its purchases of Russian oil, from 50,000 barrels in August to 420,000 barrels in September, but also only under conditions of significant discounts, which are $5–6 below Brent.

© Tyler Hicks/The New York Times

Construction sites multiply across Ukraine while factory floors stay empty. The National Bank’s August business survey reveals an economy moving at fundamentally different speeds—a division that signals resilience and vulnerability for the country’s long-term prospects.

This sectoral divide marks Ukraine’s transition from an export economy to a reconstruction economy—a fundamental shift that may outlast the war.

The data prove that Western allies’ reconstruction aid works exactly as intended: it stimulates domestic activity and maintains consumer confidence. But it also exposes the limits—private industrial investment won’t return until security dramatically improves.

The split offers a roadmap for global businesses watching Ukraine.

Local-serving sectors like construction, retail, and consumer services can function and grow during wartime. Export-oriented manufacturing and complex services remain too vulnerable to sustained attack.

Construction companies hit their fourth month of optimism in August, with their business confidence index reaching 54.0—the only major sector firmly in positive territory.

Builders expect more orders, expanded workforces, and steady material supplies as reconstruction accelerates.

The optimism reflects a geographic shift: Western regions like Lviv and Ivano-Frankivsk lead activity as internal migration and safety drive housing demand, while companies struggle with acute labor shortages—over 150,000 missing workers force wage increases of 23%.

The confidence shows up in import data: machinery imports surged 50% in July, feeding construction demand for everything from cranes to concrete mixers.

Trading firms, such as retailers, food distributors, and consumer goods companies, joined the optimism at 51.8, buoyed by consumer spending and fresh harvest supplies.

These companies have stayed positive for six consecutive months, suggesting Ukrainian purchasing power remains intact. At the same time, the National Bank reports that trading companies express concerns about inventory levels, suggesting supply chain pressures beneath the surface optimism.

While construction enjoys predictable six-month order backlogs, manufacturers face an entirely different reality. Manufacturing confidence barely moved to 48.7—still below neutral—as companies grapple with destroyed facilities and an export market collapse.

Grain exports plunged 45.4%, while metals exports fell 5.1% as production centers face ongoing Russian attacks.

Services firms scored worst at 47.0, hammered by expensive logistics, electricity price hikes, and chronic staff shortages. Most expect to cut jobs rather than expand.

Ukraine essentially bets its future on reconstruction while its industrial base hemorrhages capacity. Construction sites signal resilience, but can’t replace the export earnings that once powered the economy.

This strategy also creates a dangerous dependency: Ukraine builds more while producing less for world markets.

Whether this proves sustainable depends on donor fatigue, military progress creating safe export corridors, and whether industrial companies can survive long enough to benefit from eventual peace.

For now, the cranes keep rising while factory chimneys stay cold. Ukraine’s economic survival depends on which trend proves more durable.

The White House has urged European countries to follow the US and impose restrictive measures on India for its purchases of Russian oil, which fund the war in Ukraine, India Today reports.

US tariffs on Indian goods

In August 2025, the US raised tariffs on goods from India up to 50%, criticizing New Delhi for supporting Russia’s economic machinery. At the same time, Washington has not imposed sanctions on China, the main sponsor of the war and Moscow’s key economic partner.

A Russian drone caught filming its own camera test in a Chinese factory before being shot down in Ukraine

India has criticized the US decision, pointing out double standards: Europe itself continues to purchase oil from Russia. EU–Russia trade in 2024 reached €67.5 billion in goods and €17.2 billion in services. Europe also imported a record 16.5 million tons of Russian LNG, the highest number since 2022.

Many critical Russian exports remain unrestricted, including palladium for the US automotive industry, uranium for nuclear power plants, fertilizers, chemicals, metals, and equipment.

Sources report that Trump also pressured India to nominate him for the Nobel Peace Prize. After being rejected, he responded with tariffs. This has prompted India to strengthen its ties with China and reinforced so-called anti-American cooperation among the so-called “axis of upheaval” countries.

Today, the US administration seeks to have Europe join in sanction pressure on New Delhi if India does not stop buying Russian oil.

The European Union has reached a long-term trade agreement with Ukraine, marking the end of wartime trade liberalisation measures, though key details of the deal remain undisclosed.

EU Trade Commissioner Maros Sefcovic and Agriculture Commissioner Christophe Hansen announced the agreement on June 30, calling it a "predictable" and "reciprocal" framework. However, they did not reveal the final quotas or volumes included in the deal. Sefcovic noted that the finer points would be finalised "in the coming days."

The new deal replaces the autonomous trade measures (ATMs) that allowed Ukrainian agri-food exports to enter the EU tariff-free since 2022. Those temporary measures expired on June 5, reinstating pre-war trade conditions for a brief period.

Structured in three tiers, the new framework introduces modest increases in quotas for products considered sensitive by EU member states, such as eggs, poultry, sugar, wheat, maize, and honey. A second group of products—including butter, skimmed milk powder, oats, barley, malt, and gluten—will see their quotas adjusted to reflect peak import levels reached since the start of the war. A third category, which includes items such as whole milk powder, fermented milk, mushrooms, and grape juice, will be fully liberalised.

Once finalised, the text of the agreement will be submitted to the Council for ratification.

Sefcovic said negotiations concluded over the weekend, less than a month after formal talks began. However, some critics claim the EU delayed the process to avoid backlash from farmers ahead of Poland’s presidential election.

The agreement also benefits EU producers, granting them greater access to the Ukrainian market for goods like pork, poultry, and sugar. But Hansen made it clear that expanded access for Ukrainian exports will depend on Ukraine’s compliance with EU agricultural standards by 2028, including rules on animal welfare and pesticide use. "This commitment also fits perfectly with Ukraine's EU accession path," he said.

The deal includes safeguard provisions, allowing the EU or individual member states to restrict imports if domestic markets face serious disruptions. “Both EU and Ukrainian producers deserve a stable and predictable basis for the future development of bilateral trade,” Hansen added.

The Kyiv IndependentYuliia Taradiuk

The Kyiv IndependentYuliia Taradiuk