Russia-China trade crashes as Moscow’s frustration with Beijing grows

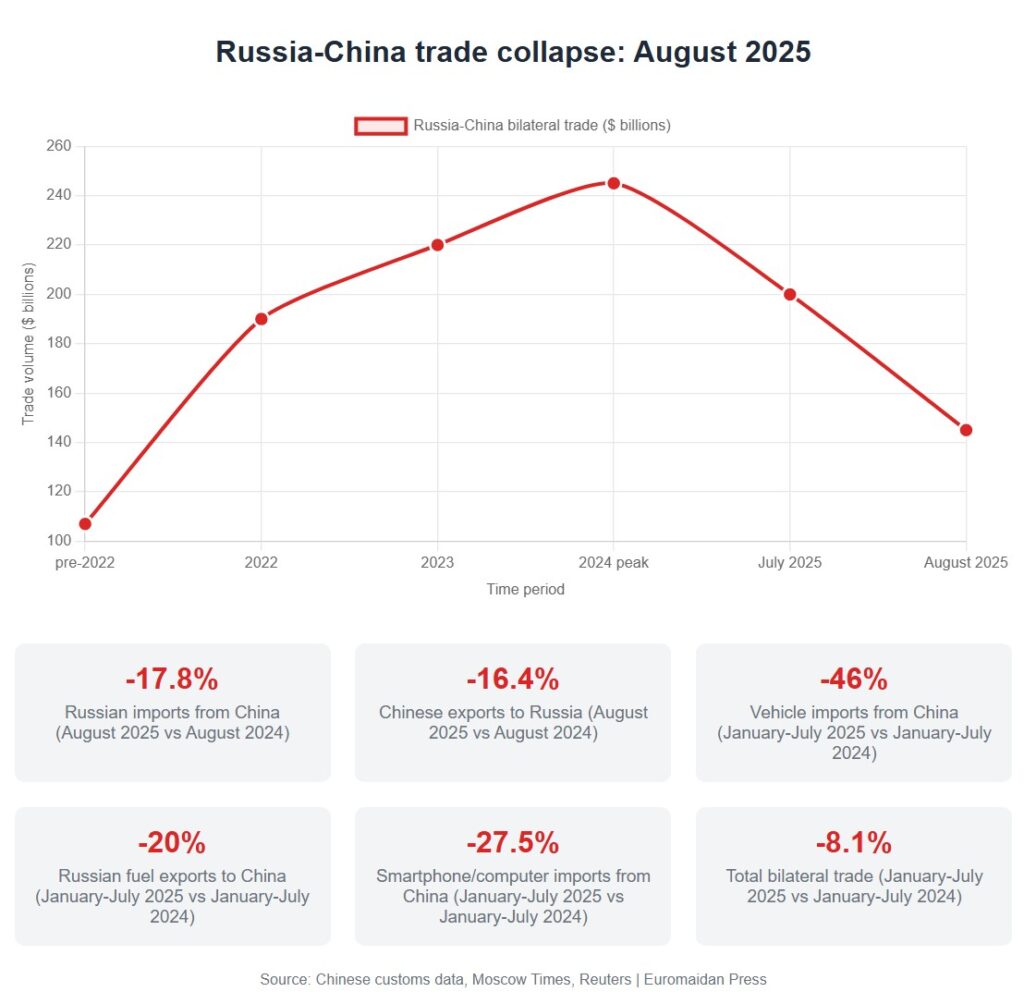

Russian imports from China plummeted 17.8% in August compared to last year, Chinese customs data shows, marking the steepest monthly decline since Moscow began relying on Beijing as its economic lifeline after invading Ukraine.

The collapse in trade that once sustained Putin’s war economy has prompted frustrated Russian officials to tell Reuters that China “does not behave like an ally” and sometimes engages in “outright robbery.”

Trade decline accelerates despite Putin’s efforts

Chinese imports from Russia dropped 17.8% year-over-year in August, while Chinese exports to Russia fell 16.4% — double July’s decline rate of 8.6%, according to Chinese customs data reported by The Moscow Times.

The cumulative damage over eight months has reduced bilateral trade by almost 9% to $145 billion, ending three years of explosive growth that began when Western sanctions forced Russia to seek alternative markets after its February 2022 invasion of Ukraine.

This decline came despite Putin’s September visit to China, where he signed what he claimed was a breakthrough memorandum on the Power of Siberia 2 gas pipeline — only to see Gazprom shares tumble 3.1% as investors recognized it as another non-binding agreement.

Sanctions pressure and market saturation take a toll

The trade decline reflects multiple pressures on the relationship. Russian Industry Minister Anton Alikhanov blamed sanctions and volatility in commodity markets for falling bilateral trade at a business forum in Kazan.

He also noted that Russia is seeing a gradual saturation of Chinese products in certain market segments.

The pressure intensified after then-Secretary of State Antony Blinken warned China during the Biden administration about sanctions evasion, which led to Chinese exports to Russia declining 16% in March 2024.

Chinese financial institutions have reportedly ceased processing yuan-denominated transactions from Russia, forcing Moscow to rely increasingly on alternative payment methods.

Key sectors show a dramatic decline

The August data reveal the breadth of the trade collapse. Russia’s fuel exports to China fell almost 20% from January to July, while vehicle imports from China — including passenger cars, tractors, and trucks — plummeted 46% to $5.8 billion.

Smartphone and computer imports dropped 27.5% over the same period, reflecting market saturation and sanctions complications.

The vehicle sector illustrates the problem of Chinese market dominance. Chinese carmakers surged from less than 10% of Russia’s auto market before the war to commanding more than half by mid-2023, creating dependency that Russian officials now regret.

Strategic implications for Moscow’s war effort

The revenue shortfall comes as Russia faces mounting costs from its prolonged war in Ukraine. The partnership had been crucial for Putin’s narrative that Russia could successfully replace Western markets with alternative relationships.

Chinese companies continue supplying components for Russian weapons production, but Beijing maintains a careful distance from direct military support while extracting maximum economic benefit from Russia’s isolation.

The trade decline suggests for Ukraine and its allies that sanctions pressure, combined with Chinese caution about secondary sanctions, is successfully constraining Russia’s ability to finance its war machine through alternative partnerships.

The deteriorating relationship also exposes the fundamental weakness in Putin’s strategy of building alternative alliances, revealing instead a relationship in which Russia has become a junior partner dependent on Beijing’s goodwill.