Australia slashes Russian oil price cap 21% while sanctioning 95 shadow fleet tankers

Australia delivers a major blow to Russia’s oil profits. The country has slashed the price cap on Russian oil from $60 to $47.60 per barrel and imposed sanctions on 95 more vessels from Russia’s “shadow fleet.” The decision was coordinated with the EU, UK, Canada, New Zealand, and Japan.

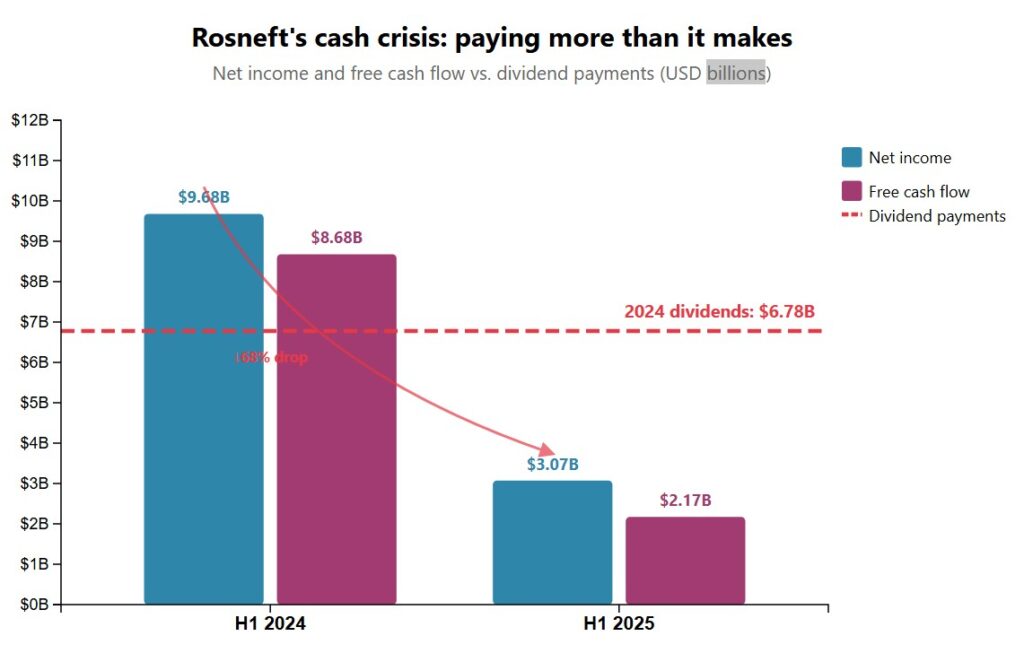

Russian oil remains a key source of revenue that funds its military aggression against Ukraine. In 2025, profits from the oil and gas sector account for about 77.7% of Russia’s federal budget.

According to the International Liberty Institute, the main buyers of Russian oil remain Asian countries, as European markets are largely restricted by sanctions.

The Australian Foreign Ministry has stated that lowering the oil price cap from $60 per barrel to $47.60 will reduce the market value of Russian crude and help deprive Russia’s war economy of revenue from raw materials.

The government also maintains a total ban on Russian oil and petroleum product imports. More than 150 ships have been sanctioned since June 2025.

Australia tightens grip on Russia’s “shadow fleet”

The latest measures target 95 tankers, with intelligence on 60 vessels provided to international partners by Ukraine’s sanctions group.

“Ukraine has also imposed national sanctions on the captains of 15 of these tankers,” Andrii Yermak, the head of the Ukrainian Presidential Office, reveals.

Ukraine welcomes Canberra’s support

Ukraine’s Foreign Minister Andrii Sybiha has thanked his Australian counterpart Penny Wong for the decision.

“Australia is helping to restrict Russia’s ability to fund its war and undermine global peace. We value our strong partnership with Australia and continue to stand together for shared values,” he said.

A united front to cut the Kremlin’s oil revenues

Australia’s sanctions are part of a wider Western strategy to reduce the Kremlin’s energy income. Partner governments believe that only sustained pressure on Russia’s oil sector can significantly weaken its capacity to fund the war against Ukraine.