London court beats oligarchs that Kyiv wouldn’t touch

What does it take to steal $2 billion from your own bank? According to a London High Court, all you need is 50 shell companies, a culture of fear, and four years to perfect the art of making money disappear.

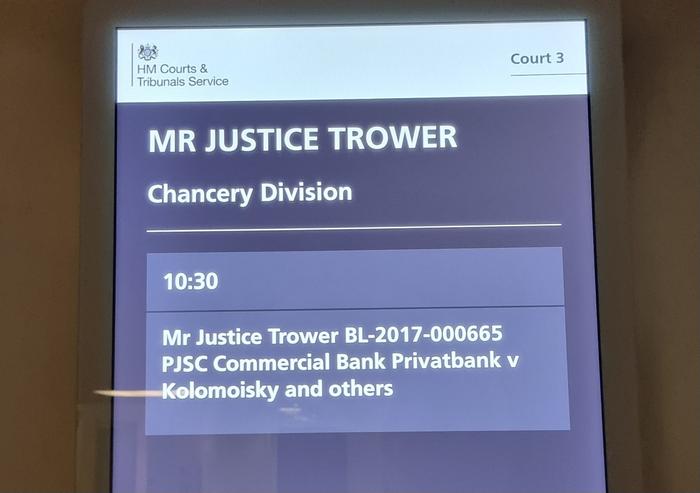

Ukrainian oligarch Ihor Kolomoiskyi found out the hard way that his thorough looting of PrivatBank — Ukraine’s largest financial institution —has consequences. On 30 July, Justice Trower ruled that Kolomoiskyi and his longtime partner Hennadii Boholiubov (Bogolyubov) orchestrated a brazen fraud that nearly collapsed Ukraine’s entire banking system.

$1.91 billion—roughly 1.5% of Ukraine’s 2014 GDP—vanished through fake loans, phantom supply contracts, and offshore shell games between 2010 and 2014.

Ordinary oligarch theft this wasn’t. Kolomoiskyi and Boholyiubov, then Ukraine’s second and third richest persons, spent four years hollowing out Ukraine’s financial backbone while regulators watched—some bought off, others too intimidated to act.

The man behind the scheme

For international readers, Kolomoiskyi isn’t just any businessman.

He’s the oligarch who once controlled roughly 10% of Ukraine’s GDP through his Privat Group empire. His TV channel, 1+1, made Volodymyr Zelenskyy a household name long before anyone imagined the comedian would become president. His private militia helped defend Ukraine against Russian-backed separatists in 2014. His influence reached governorships, media empires, and the very heart of Ukrainian politics.

This court ruling is particularly striking because it shows that even oligarchs who once seemed untouchable can face justice —just not always at home.

How to steal a bank in four easy steps

The London court laid out Kolomoiskyi’s playbook with forensic precision:

Step 1: Create the borrowers

Between 2010 and 2014, PrivatBank issued hundreds of loans to over 50 shell companies. These weren’t real businesses — most had no operations, employees, or purpose except to receive money. Kolomoiskyi and Boholiubov secretly controlled all of them.

Step 2: Move the money offshore

Those fraudulent loans were immediately transferred to corporate defendants in the UK and British Virgin Islands under the pretense of “prepayments” for goods. The court’s finding? None of the goods were delivered, and the payments were never returned. Cyprus was the key pipeline, with PrivatBank’s branch facilitating over $2.3 billion in foreign currency transfers.

Step 3: Recycle to hide the theft

When loans came due, new fake loans were issued to repay the old ones. This “loan recycling” created an illusion of solvency while the money flowed to accounts controlled by the oligarchs. In 2016, just before nationalization, PrivatBank issued a final $5.7 billion in “new loans” — a desperate attempt to cover the massive hole in the bank’s balance sheet.

Step 4: Create fake lawsuits for cover

In late 2014, as Ukrainian regulators began asking uncomfortable questions, 46 of the 50 shell companies filed lawsuits demanding repayment from their supposed suppliers. Courts issued favorable rulings that were never enforced. Justice Trower found that “the judgments in the 2014 Ukrainian Proceedings were collusively obtained” — legal theater designed to fool regulators.

The culture of silence

What enabled this massive theft? Fear.

The court found that senior PrivatBank employees, including top management, facilitated the scheme under direct orders from Kolomoiskyi and Boholiubov. Compliance failures weren’t accidental — they were deliberate, driven by intimidation and a culture where asking questions could end careers or worse.

Even National Bank of Ukraine officials faced threats when they tried to investigate. The court noted that Kolomoiskyi made threats against NBU deputy governor Kateryna Rozhkova, telling her he was “a hungry tiger in a cage” with “very long arms” who could reach her anywhere.

In Kolomoiskyi’s Ukraine, silence wasn’t golden — it was survival.

Kolomoiskyi threatened Ukraine’s National Bank deputy governor, saying he was a “hungry tiger in a cage” with “very long arms.”

The oligarchs’ desperate defense

When cornered with overwhelming evidence, Kolomoiskyi and Boholiubov deployed every legal argument their top-tier counsel could muster.

Why would sophisticated oligarchs with unlimited legal resources make arguments a London judge would find “procedurally flawed”? The answer reveals just how desperate their situation had become.

Their primary defense was breathtakingly audacious: they claimed they repaid fraudulent loans through later “asset transfers” and “loan transformations.” According to this logic, you can’t defraud someone if you later “repay” them — even if that repayment comes from more fraudulent money.

Justice Trower quickly demolished this argument. The supposed “repayments” were not genuine but part of artificial schemes using further fraudulent loans.

It was circular fraud, not actual repayment.

Boholiubov throws Kolomoiskyi under the bus

Boholiubov claimed complete independence from his longtime partner in a move that backfired spectacularly. He suggested the scheme involved bank management acting without his knowledge or approval, essentially throwing Kolomoiskiy and PrivatBank’s management under the bus.

The court wasn’t buying it. Justice Trower examined Boholiubov’s reaction to devastating NBU audit reports that exposed massive related-party lending consuming over 70% of the bank’s assets.

A truly uninvolved chair would have demanded investigations and fired management. Instead, Boholiubov voted to reappoint the same Management Board and praised their “satisfactory” performance.

“I think that the Bank is correct to submit that Mr Boholiubov’s reaction to this highly critical report was the opposite of what a person in his position with no prior knowledge of these deficiencies would have done,” Justice Trower wrote. The judge found that Boholiubov’s lack of surprise at the audit findings “reflects and corroborates the other circumstantial evidence that they knew and approved of lending in the form of the loan recycling scheme.”

The silence that spoke volumes

Perhaps most damaging was what the oligarchs didn’t do. When confronted with evidence of massive fraud, neither demanded investigations nor took disciplinary action against management, which they now claimed had acted without their knowledge. They withdrew their witness statements, and neither appeared in court to testify under oath.

The court found “it is inherently unlikely that any of the steps in the Misappropriation were not known and approved by both of them.” The judge drew adverse inferences from their refusal to testify and their behavior throughout the proceedings.

The nationalization defense that never was

Kolomoiskyi attempted one final gambit: arguing that PrivatBank’s new management after nationalization had “consciously decided” to treat certain fraudulent transactions as valid when they signed off on 2016 financial statements. This “free-choice extinction” defense suggested the bank had voluntarily accepted the fraud.

Justice Trower noted this argument was never properly pleaded and would have been rejected for causing prejudice anyway. It revealed the desperation of oligarchs grasping at procedural technicalities.

Document destruction and deliberate obstruction

The court found that both oligarchs had destroyed documents that could have been evidence in the case. Justice Trower noted that Kolomoiskyi admitted in his disclosure certificate that his “general practice has been not to retain hard copy documents” and his “practice has been to dispose of the document immediately or once any action points have been completed.”

More damning, the judge found that “Mr Kolomoiskyi took deliberate decisions to procure the destruction of data which was capable of being relevant to the current proceedings.” The court determined that Kolomoiskyi’s approach to disclosure was to “delay and obfuscate for as long as possible in the hope that these documents would not come out.”

This behavior fits a pattern. The court found that Kolomoiskyi “seems to have regarded himself as above the law,”A while Boholiubov’s attempts to claim ignorance were undermined by his actions as chairman of the supervisory board.

From kingmaker to pariah

This judgment captures Kolomoiskyi at a remarkable inflection point.

Once powerful enough to install governors and potentially influence presidential elections, he now faces legal challenges on multiple continents while sitting in a Ukrainian jail.

The transformation has been swift.

- In 2019, Kolomoiskyi’s media empire helped propel Zelenskyy to the presidency.

- By 2021, the US State Department had banned him and his family from American soil due to “significant corruption.”

- The US Department of Justice has filed four separate civil forfeiture cases since 2020 through its Kleptocracy Asset Recovery Initiative, targeting hundreds of millions in American real estate allegedly purchased with laundered PrivatBank funds.

- Ukrainian prosecutors have reopened local investigations, and Kolomoiskyi was arrested in September 2023 on separate embezzlement charges.

Meanwhile, Ukrainian investigators report that Boholiubov illegally fled the country in July 2024 using forged documents and was temporarily residing in Vienna. Both maintain their innocence, but their legal options are rapidly narrowing — any appeal of the London judgment has been adjourned until October 2025.

The Great Escape: How Ukraine’s ninth-richest man slipped out of the country amid fraud allegations

Zelenskyy, meanwhile, has carefully distanced himself from his former media patron — a political necessity as Ukraine seeks international legitimacy and aid.

What this means beyond Ukraine

This isn’t just a Ukrainian story. The London judgment establishes crucial precedents for international asset recovery, applying Ukrainian civil law through English commercial courts. It creates a roadmap for other countries whose oligarchs have hidden stolen assets abroad.

For Ukraine’s international backers — the EU, IMF, and bilateral donors —this ruling sends a clear signal: foreign courts can hold influential figures accountable even when domestic institutions struggle to do so.

As Ukraine continues seeking financial support for reconstruction and reform, demonstrating that justice can reach even the most connected oligarchs matters enormously.

The bigger question

While PrivatBank can now pursue enforcement actions to recover assets in the UK and beyond, a fundamental question remains: can Ukraine’s courts deliver similar justice?

The London ruling proves the facts were there all along. The evidence was overwhelming. The legal framework existed. What was missing was the political will and institutional independence to act.

PrivatBank’s own lawyers made this case explicitly. According to Forbes Ukraine, the bank “provided evidence why it could not file lawsuits against Kolomoiskyi in Ukraine,” arguing that “the defendant’s power and influence in the country made this impossible.”

This oligarchic reach seemed to extend even to London.

According to the Law Gazette, Justice Trower expressed alarm after discovering that a draft judgment had been leaked to Ukrainian social media and Cypriot corporate service providers before the official announcement.

The judge told the court he was “very alarmed by some correspondence I received last night,” noting that the draft “seems to have been leaked in such a manner that it would become available on social media sites in Ukraine” and to “one of the corporate service providers in Cyprus.”

He added: “On the face of it, if there has been a leak which looks like it might have been, the court takes that very seriously indeed.” The Law Gazette reported that the source of the leak remains under investigation.

The London victory proves oligarchs can be held accountable—somewhere. Whether Ukraine can build that capacity at home remains the crucial test for a country still battling Russian aggression while trying to build a genuine rule of law.

Kolomoiskyi’s London defeat might be the beginning — or it might remain an exception that proves the rule about where real justice happens for Ukraine’s oligarchs.

Timeline: From fraud to judgment

- 2010-2014: PrivatBank issues over $2.3 billion in fraudulent loans via 50 shell borrowers

- 2014: Bogus repayment lawsuits filed in Ukrainian courts to create cover

- December 2016: National Bank of Ukraine declares PrivatBank insolvent and nationalizes it to prevent financial system collapse

- 2017: UK court grants freezing orders; PrivatBank files civil fraud claim in London

- 2018-2019: Legal disputes over jurisdiction; UK Court of Appeal allows case to proceed

- 2023: Full trial held in London High Court

- 30 July 2025: Final judgment confirms Kolomoiskyi and Boholiubov liable for $1.91 billion

This article was amended after publication to include the Forbes Ukraine data on why Privatbank was unable to sue Kolomoiskyi in Ukraine