Ukraine just built a European-gauge railway during the war

Direct trains from Uzhhorod to Vienna, Budapest, and Bratislava start running on 12 September 2025, marking Ukraine’s first step toward abandoning its Soviet-era railway infrastructure in favor of European standards.

Ukraine’s completion of its inaugural European-gauge railway line represents more than improved travel times—it demonstrates how a country under invasion is advancing rail integration faster than some existing EU members who have debated similar projects for decades.

While Baltic states have spent twenty years discussing conversion from Russian to European track standards, Ukraine delivered its first 22-kilometer European-gauge connection in under twelve months, creating the first direct passenger link between a Ukrainian regional capital and EU markets.

Breaking from Moscow’s rail grip

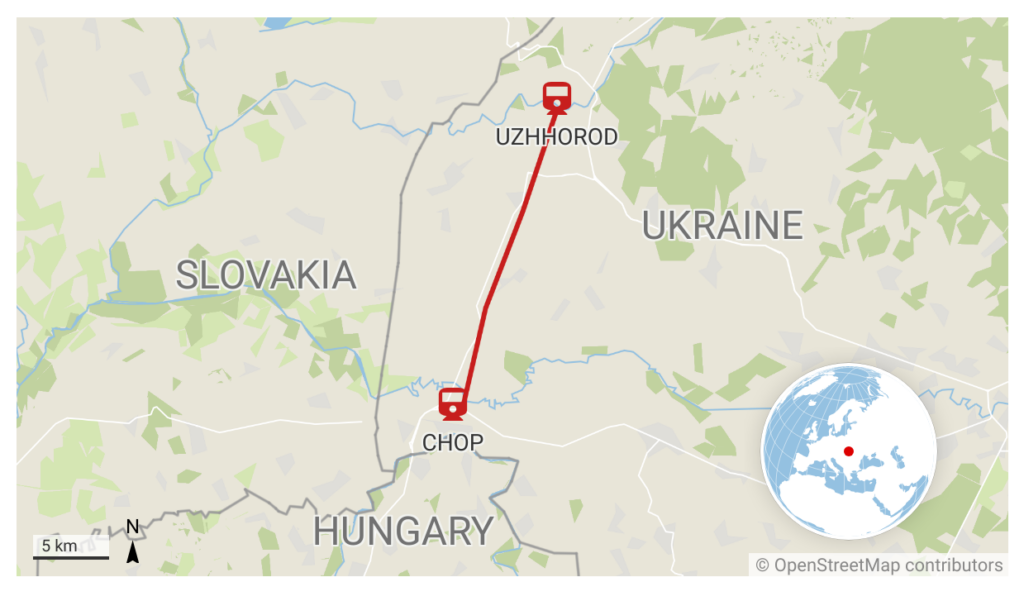

The new line from the capital of Zakarpattia oblast, Uzhhorod, to Chop near the Ukraine-Slovakia-Hungary tripoint uses the standard European gauge of 1,435 mm instead of Ukraine’s current 1,520 mm Soviet broad gauge, eliminating time-consuming train changes at borders that have slowed passenger and freight movement for decades.

“For the first time in Ukraine’s modern history, a European-gauge railway has been built from scratch—a 22-kilometre stretch between Chop and Uzhhorod. Thanks to this, Uzhhorod has become the first regional centre to gain a direct European-gauge connection with EU countries—including the capitals Bratislava, Budapest and Vienna,” said Chairman of the Management Board of JSC Ukrainian Railways (Ukrzaliznytsia) Oleksandr Pertsovskyi.

The €28.6 million ($33.6 million) project, funded equally by a European Investment Bank loan and EU Connecting Europe Facility (CEF) grant, was completed months ahead of its 2026 timeline despite wartime conditions.

Ukrainian railway workers laid 60,000 concrete sleepers, 4,000 tons of rails, and 69,600 cubic meters of ballast while installing modern Ukrainian-made signaling systems with microprocessor control.

The 22-kilometre project was finished for less than 30 million euros, whereas in the EU, the costs of building a railway vary between 12 and 45 million euros per kilometre.

Faster than the Baltics

Ukraine’s rapid progress contrasts sharply with established EU members struggling with similar conversions. The Rail Baltica project, intended to connect Estonia, Latvia, and Lithuania to European-gauge networks, has faced delays and cost overruns since its 2014 launch, with completion now pushed to 2030.

The contrast underscores Ukraine’s urgency in breaking Soviet-era dependencies.

While Baltic states joined NATO and the EU in 2004, they retained Russian-gauge railways; Ukraine treats infrastructure conversion as essential to its survival and European integration.

Strategic infrastructure as a geopolitical statement

“Ukrzaliznytsia has become a true lifeline during Russia’s war of aggression—for citizens seeking safety, for businesses sustaining the economy, and as a channel of “iron diplomacy,” bringing world leaders to Ukraine in solidarity and support. It is a first, but very significant step towards fully integrating Ukraine’s railways with the European network, and towards Ukraine’s future inside the European family.” said Ambassador of the European Union to Ukraine Katarína Mathernová.

This project is part of the extended Trans-European Transport Network (TEN-T) corridors inside Ukraine.

Under the Connecting Europe Facility, the European Commission has provided €110 million ($129 million) in non-reimbursable support (mobilising €220 million ($258.6 million)) to integrate the Ukrainian and EU rail systems along these corridors, including a July grant of €76 million ($89 million) for the Poland–Lviv standard-gauge line.

Lviv connection next

Officials have already announced the next phase: extending standard-gauge track from the Polish border to Lviv, Ukraine’s largest western city. Pertsovskyi has also set out near-term execution goals:

“Already in 2026, we plan to electrify this section and begin construction of the European-gauge line towards Lviv, which we intend to complete within 2–3 years.”

The July CEF grant supports the Poland–Lviv link, creating a direct standard-gauge route from Ukraine’s industrial heartland to EU markets.

Future plans include additional European-gauge sections in Zakarpattia and Volyn oblasts, routes to the Czech Republic, Hungary, and Poland, and comprehensive freight corridors from Ukrainian industrial centres to European ports and markets.

Wartime integration and EU timelines

“This is a historic step towards EU integration. Especially in wartime, when railways serve as a vital lifeline for Ukraine’s economy and people, strengthening these transport links is more important than ever.” said Teresa Czerwińska, Vice-President of the European Investment Bank.

The €50 billion ($58.7 billion) Ukraine Facility (2024–2027) and CEF support are front-loading investment to tie Ukraine into TEN-T while the war continues, demonstrating delivery capacity under fire.

That compresses the traditional accession sequence—stabilise politics, build institutions, then knit infrastructure.

If Ukraine can convert track, align signalling, and meet EU technical standards faster than some members did in peacetime, other milestones, then market access, regulatory alignment, and TEN-T build-out need not wait for a “perfectly stable” post-war moment.

The policy question for Brussels is whether wartime institutional capacity should accelerate, rather than delay, integration.