Ukraine’s $185 billion war tab threatens everything after victory

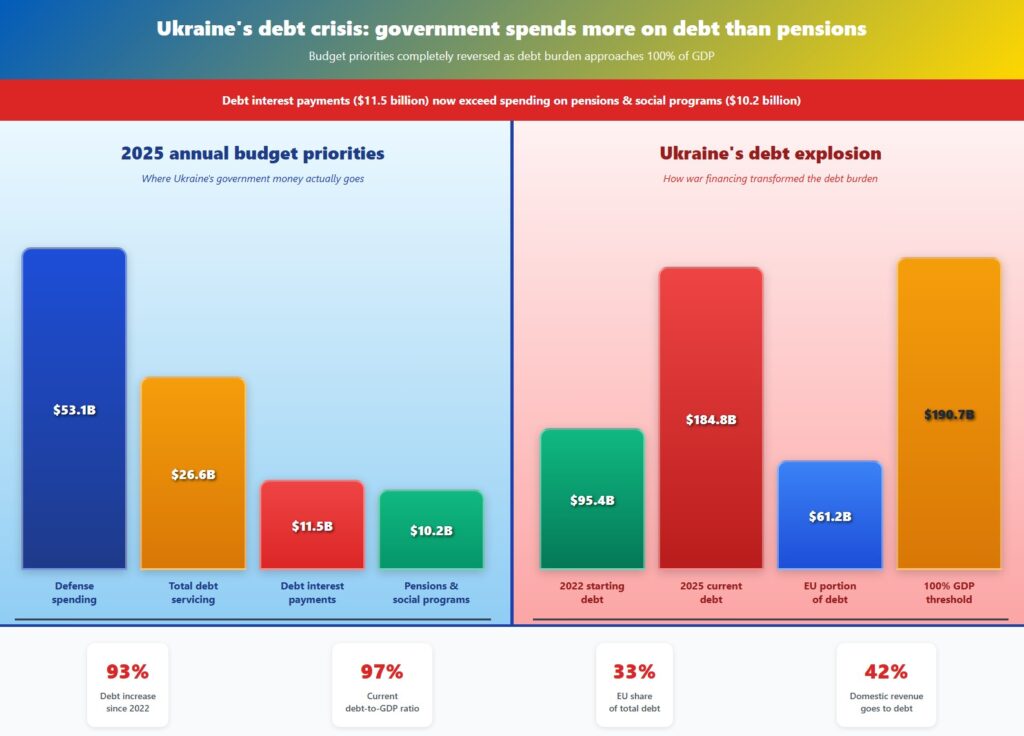

This marks a dramatic shift in priorities as the country’s borrowing burden approaches 100% of GDP.

According to Finance Ministry data analyzed by Economic Pravda, the government will spend 475.84 billion hryvnias ($11.5 billion) on debt interest payments alone in 2025, while allocating just 421.43 ($10.16) billion hryvnias to pensions and social programs combined.

This represents a fundamental reversal from before Russia’s full-scale invasion, when social spending dominated government expenditures.

Despite the war, Ukraine’s economic resilience has allowed it to maintain 1% quarterly GDP growth and reduce inflation to 14.1% (as of July 2025).

Still, the mounting debt burden threatens the sustainability of the country’s war effort and post-conflict recovery.

The national debt has nearly doubled from $95.4 billion in February 2022 to $184.8 billion by July 2025, pushing the debt-to-GDP ratio to 97%—dangerously close to the psychologically critical 100% threshold.

War financing reshapes government priorities

The shift in budget priorities reveals how three and a half years of conflict have fundamentally restructured Ukraine’s finances. Defense spending now consumes half of all government expenditures—equivalent to the country’s entire tax revenue—while debt servicing has displaced social welfare as the second-largest budget category.

Total debt servicing and repayment will cost approximately 1.1 trillion hryvnias ($26.6 billion) in 2025, representing 42% of all domestic budget revenues from Ukraine’s economy.

In other words, nearly half of what the state collects from its citizens goes directly to creditors rather than public services.

“Further accumulation of even concessional debt over an extended period could increase the debt burden to levels that hinder economic development. But in an existential war, it’s better to have high debt than face a funding shortage,” Dragon Capital analyst Olena Bilan told Economic Pravda.

The International Monetary Fund projects Ukraine’s debt will reach 110% of GDP by the end of 2025, putting it in the range of heavily indebted developed nations like Italy (144% debt-to-GDP) or Portugal (116%).

While such levels are not unprecedented—Japan operates with debt exceeding 260% of GDP—Ukraine faces the additional burden of being an active war zone requiring massive defense expenditures while keeping the country functioning and rebuilding damaged infrastructure.

All at the same time.

European Union is the largest creditor

The European Union is Ukraine’s dominant creditor, holding $61.16 billion of the country’s debt—roughly one-third of the total burden. This includes financing backed by frozen Russian assets through the G7 loans program called Extraordinary Revenue Acceleration for Ukraine, or ERA, where repayment will come from income generated by those confiscated funds rather than Ukrainian taxpayers.

At the same time, the war has fundamentally altered Ukraine’s creditor structure.

External debt now exceeds domestic borrowing by a 4-to-1 ratio, making Ukraine vulnerable to currency fluctuations.

If the hryvnia weakens to 43.5 per dollar, the debt burden could reach 102% of GDP by year’s end, according to Bilan, quoted in the Economic Pravda analysis. If the National Bank manages to keep the hryvnia at 41.5 per dollar, the debt burden will stay at the current level—98% of GDP.

In 2024, Ukraine successfully restructured its private commercial debt, writing off $9 billion owed to Eurobond holders. However, most of its current debt consists of government-to-government loans that cannot be restructured through conventional means.

Economic stability masks underlying pressure

Despite the mounting debt burden, Ukraine’s economy shows surprising resilience. The National Bank reported that GDP grew approximately 1% each quarter in the first half of 2025, while inflation declined from slightly higher levels earlier in the year to 14.1% in July.

The government expects to receive a record $54 billion in external assistance during 2025, creating what officials describe as a “safety cushion” for the following year.

International support has enabled Ukraine to maintain critical social payments and government operations while dedicating nearly all domestic revenues to defense.

However, structural challenges persist. According to UN data cited in the National Bank report, approximately 5.6 million Ukrainians remain abroad as of July 2025, creating labor shortages that constrain production capacity and economic growth potential.

Limited options for debt reduction

According to the Economic Pravda analysis, Ukraine has three potential paths to managing its growing debt burden.

Firstly, economic growth could gradually reduce the debt-to-GDP ratio, as occurred between 2016 and 2021, when Ukraine lowered its debt burden from 81% to 45.2% of GDP. However, the war has destroyed key industrial assets and energy infrastructure that previously generated much of the country’s economic output.

Debt restructuring offers another option, but the predominance of official creditor loans limits this approach.

“Most official debt cannot be restructured. More likely, borrowing from official creditors will be refinanced when access to financing improves, including through Ukraine getting closer to the EU,” Bilan explained to Economic Pravda.

European integration represents the third pathway, potentially improving Ukraine’s creditworthiness and borrowing terms as the country moves toward EU membership. However, this process requires years of institutional reforms while Ukraine simultaneously fights for survival.

The mounting debt burden increasingly constrains Ukraine’s fiscal flexibility, leaving less budget space for reconstruction programs and economic development initiatives that could help the country transition to a sustainable post-war economy.