Europe coins “Iranization” as Russia’s isolation deepens

“Iranization” describes a country that is stuck with limited modernization, long-term stagnation, and a deepening dependence on China. It’s the first major Western institutional attempt to define Russia’s trajectory as structurally comparable to Iran’s decades-long isolation.

The deterioration is accelerating faster than mid-year projections suggested.

Russia’s reserves are depleting and deficits mounting through October. Moscow retains the capacity to sustain its invasion through 2026, but the economic model is collapsing into stagflation.

What “Iranization” means

The French Institute of International Relations (IFRI) report, “Europe-Russia: Balance of Power Review,” supervised by nine European think tank directors, defines the term precisely.

Russia’s modernization potential is curtailed, growth will slow severely, and dependence on China will deepen.

Like Iran after decades of sanctions, Russia faces structural isolation from Western markets, financial systems, and technology transfers.

June predictions, October reality

IFRI’s mid-year assessment saw trouble coming. Russia’s economic momentum had peaked by year-end 2024 and was drifting into stagflation. The warning signs included rising inflation, a projected budget deficit of 2.6% in 2025, and the National Wealth Fund’s liquid portion shrinking to $31.5 billion by June 2025.

Four months later, the trajectory is accelerating.

Russia’s budget deficit hit 4.2 trillion rubles ($48.2 billion) in the first eight months of 2025—four times higher than the previous year, per Russian Finance Ministry data. The National Wealth Fund now stands at roughly $40 billion, continuing its decline despite a modest uptick from June.

Russia entered stagflation exactly when IFRI predicted, with deterioration accelerating through autumn.

The €160 billion gas reckoning

Russia’s isolation shows most starkly in the energy. IFRI calculates Russia’s gas sector won’t recover from losing the European market—€160 ($185) billion in lost Gazprom export revenue over 2025-2030.

This isn’t cyclical disruption. It’s irreversible structural damage.

Yet, as IFRI points out, Europe absorbed the shock. Fossil-fuel import bills halved compared to 2022 levels—over €250 ($288) billion in annual savings for European countries.

The IFRI report notes Europe has implemented an unprecedented industrial policy shift, strengthening resilience and competitiveness while positioning itself to become the world’s most electrified economy and global climate leader by 2030.

War capacity persists

The critical caveat: Russia’s ability to sustain the war effort isn’t exhausted, particularly if oil prices remain stable. Lower oil prices or additional strict sanctions would create precarious conditions, but Moscow retains operational capacity for now.

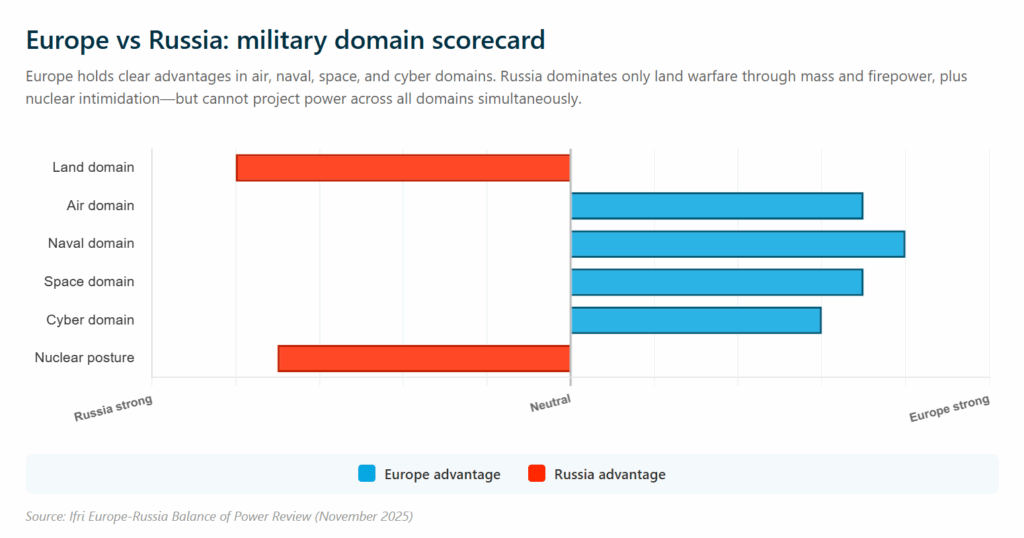

The IFRI assessment notes that while Russia retains war-fighting capacity, Europe holds clear advantages in air, naval, space, and cyber domains. Russia dominates only land warfare through mass and firepower, plus nuclear intimidation, but cannot project power across all domains at once. Outside Ukraine’s ground war, the military balance remains decisively in Europe’s favor.

The significance of “Iranization” as terminology? It reveals a shift in Western strategic thinking.

Nine European think tank directors supervised this assessment—the first formal Western research framework to treat Russia’s trajectory as permanent structural isolation rather than a recoverable disruption. European planners aren’t asking whether Russia’s economy will recover after the war ends. They’re analyzing how Moscow will function as a sanctioned, isolated state dependent on China for survival, mirroring Tehran’s trajectory over four decades.