Revenue rises, taxes fall: Ukraine’s budget twist explained

Ukraine’s government collected $1.3 billion more in revenue than budgeted through October, despite recent findings that 94 business sectors increased earnings while simultaneously cutting tax payments.

While businesses optimized their tax bills, other revenue sources—particularly import taxes and personal income levies—performed slightly better than projected. The modest overperformance provides marginally more fiscal breathing room, though Ukraine remains heavily dependent on external financing to cover its massive budget deficit.

Business sentiment remained cautiously optimistic through October despite ongoing Russian attacks.

“There are currently no risks regarding the implementation of planned defense expenditures,” Roksolana Pidlasa, who chairs the Verkhovna Rada’s budget committee, wrote on Facebook on 3 November, sharing operational budget data showing total revenue of 1.76 trillion hryvnias ($42.8 billion)—53.3 ($1.27) billion hryvnias above the ten-month target.

How Ukraine collected more while businesses paid less

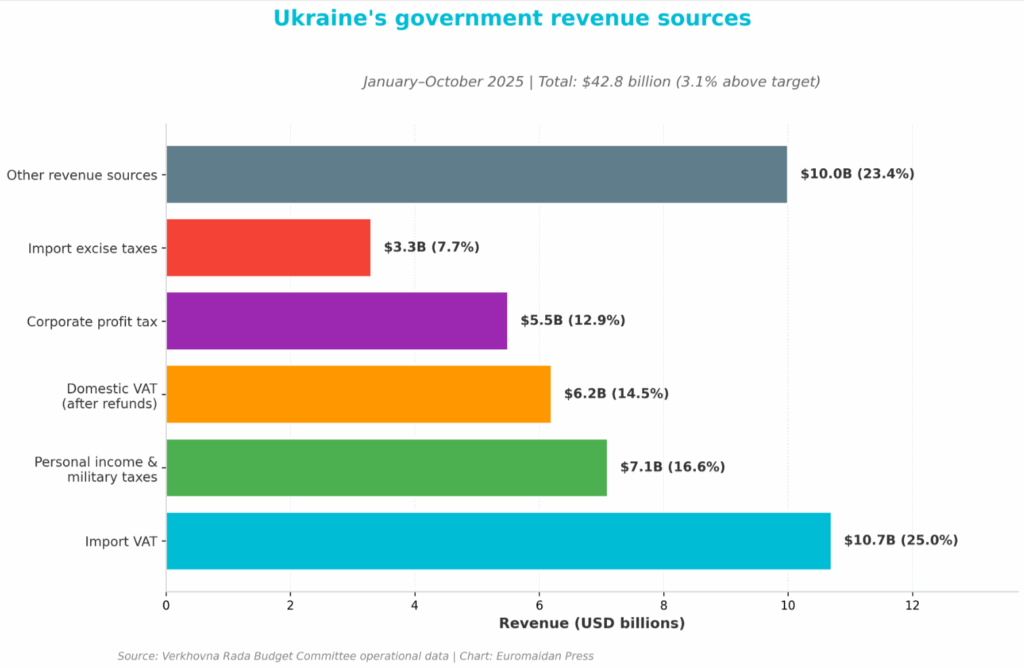

The revenue contradiction stems from Ukraine’s diversified tax base performing unevenly across sectors. Import VAT generated $10.7 billion—the largest single revenue source and well above targets as wartime consumption patterns shifted toward imported goods.

Personal income and military taxes brought in $7.1 billion, exceeding projections as employment remained surprisingly stable despite ongoing mobilization.

Corporate profit tax yielded $5.5 billion, also above the ten-month target, even though 94 business sectors reported higher revenues alongside lower tax payments. The gap suggests that while some companies optimized their tax positions, the overall corporate base expanded enough to offset individual reductions, or other companies substantially increased their contributions.

Domestic VAT after refunds added $6.2 billion, and import excise taxes contributed $3.3 billion. Only two categories—import VAT and domestic excise—failed to exceed their adjusted targets, indicating broad-based fiscal resilience rather than dependence on a few revenue streams.

Defense spending dominates domestic resources

Ukraine allocated 2 trillion hryvnias ($48.7 billion) to defense over the ten-month period, representing 63.3% of all general fund expenditures. This figure confirms a critical point for Western policymakers: Ukraine finances its war effort predominantly from domestic revenue, not international aid.

Through October, the country received $37.1 billion in international assistance, most of which went to civilian needs like salaries, pensions, and social programs.

Total general fund expenditures reached 3.2 trillion hryvnias ($77.9 billion)—73.7% of the annual plan. Beyond defense, major spending categories included debt repayment ($10.7 billion), social protection for veterans ($7.8 billion), debt servicing ($6.8 billion), medical guarantees ($3.4 billion), and teachers’ salaries ($2.3 billion).

Ukraine supplemented tax revenue with $11.5 billion from domestic bond placements to finance the budget deficit.

What this means for Western aid calculations

The revenue overperformance arrives as Ukraine faces a projected budget deficit of 25% of GDP in 2025, requiring $51.5 billion in external financing. The 3.1% beat provides slightly more fiscal headroom than budgeted, though the fundamental financing gap remains.

The National Bank of Ukraine estimates the country needs declining external support through 2027—from $51.5 billion this year to $45 billion in 2026 and $39 billion in 2027.

Business optimism holds despite energy attacks

The revenue figures align with Ukrainian businesses maintaining cautiously optimistic outlooks despite intensifying Russian attacks. The National Bank of Ukraine’s business activity expectations index reached 50.3 in October—slightly above the neutral threshold of 50—according to a survey published on 3 November.

Trading companies showed the strongest optimism with an index of 54.3, driven by robust consumer demand and decelerating inflation. Construction firms reached 53.3, boosted by budgetary spending on infrastructure restoration and road construction.

Industrial companies reported more guarded expectations at 48.8, citing ongoing destruction of production facilities, high restoration costs, and power cuts. Services companies registered 48.7, affected by damaged railway infrastructure and persistent labor shortages.

The National Bank noted that while international financial assistance and stable foreign exchange markets supported positive sentiment, intensifying Russian attacks on energy infrastructure and production facilities remained constrained economic activity.

The business activity data explains part of the revenue resilience: companies operating and consumers spending generate tax revenue even when individual sectors optimize their tax bills. The National Bank noted that intensifying Russian attacks on energy infrastructure constrain growth, but haven’t derailed economic activity—explaining how Ukraine exceeded revenue targets despite the tax optimization paradox.